- During the session on Thursday, we have seen the US dollar fall against almost everything, and the Canadian dollar was not any different.

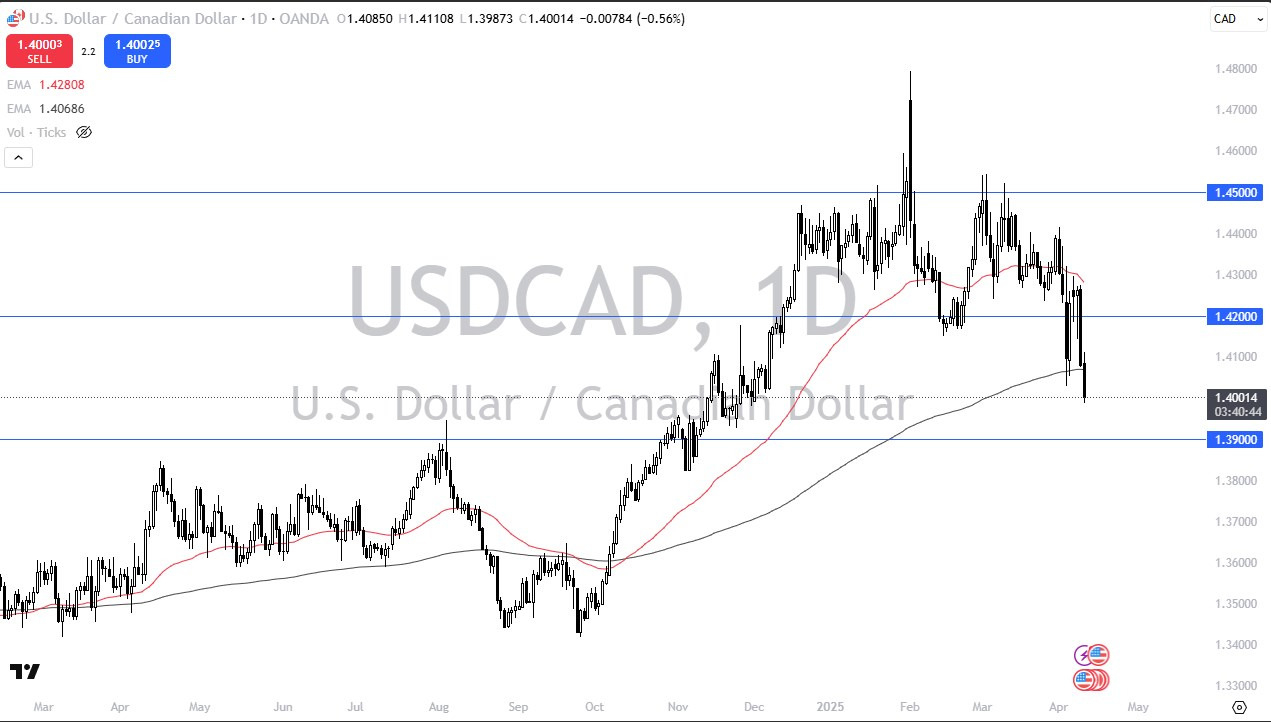

- We are now below the 200 Day EMA, and therefore it does make a certain amount of sense that we could see a little bit of follow through, especially after the CPI numbers came out cooler than anticipated.

- Traders are now starting to think that perhaps the Federal Reserve could intervene, but I think we are a long way from making that happen.

Major Support Below

What I am watching very closely as the 1.39 level. This is an area that could be massive support for the US dollar, and let’s be very clear here, Canada isn’t exactly doing well. Furthermore, the Canadian economy is highly levered to the US economy, so even if the US economy does falter, that is going to have a major negative impact on the Canadian economy as well. That being said, we will have to watch what the 1.39 level says or does, because that could determine where we spend the next 3 months.

Top Forex Brokers

On the other hand, if we were to turn around and break above the 1.41 level, then it opens up the possibility of a move to the 1.42 level. 1.42 level was the previous support level that we have smash through a couple of times now, and it’s probably worth noting that the candlestick from the Wednesday session closed at the very bottom, so it’s probably not a huge surprise to see that we have fallen this way.

That being said, I don’t want to get aggressively short quite yet. This is because if we break down below the 1.39 level, it could lead to a multi-month trade, so there’s no need to rush this over just a handful of pits here and there. I do think that we will have a definitive answer to what’s going to happen with the US dollar over the next couple of days, so all be watching closely.

Ready to trade our Forex USD/CAD predictions? Here are the best Canadian online brokers to start trading with.