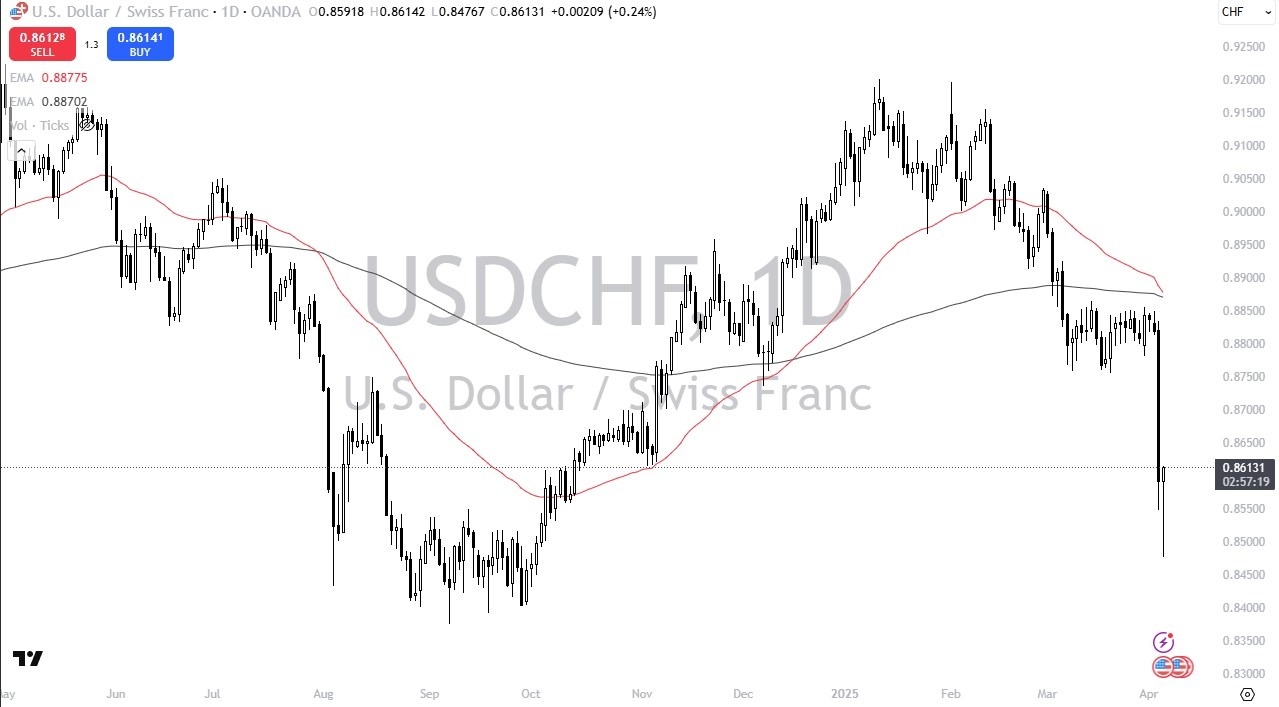

- The US dollar initially plunged at the beginning of the Friday session against the Swiss franc, but somewhere around the 0.8460 level, buyers started to step in and try to lift the dollar.

- As we head towards the end of the session, we are basically at the top of the range for the day, forming a massive hammer.

- This hammer suggests that we are in fact going to bounce from what has been a major support level.

So, I look around the rest of the Forex world and I see the US dollar truly taking off against several currencies. It's not just the Swiss franc, it's the euro, it's the British pound, British pound got crushed today, the Australian dollar, the New Zealand dollar. So, we’re starting to see people run right back to the US dollar, which does make a certain amount of sense. It is a safety currency. Ironically, I was listening to pundits on the air on financial channels this morning talk about it being counterintuitive that the US dollar sold off. But really, at this point in time, we will start to see a run to bonds and as rates drop, although it's bad for the dollar longer term, the reality is you need us dollars to buy those bonds in the Treasury market, and I think that's part of what's going on here.

Interest Rate Differential

Top Forex Brokers

Furthermore, keep in mind that although the Swiss franc is obviously a safety currency, the interest rates that the Swiss offer are anemic. So, currency traders do prefer the dollar over the franc under normal circumstances, not that we are in normal circumstances. So, I do see a significant bounce from here. Whether or not we can overtake the 0.8850 level, which would lead to a new uptrend, at least in theory remains to be seen, but we had just fell too far too quickly to sustain that type of momentum.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.