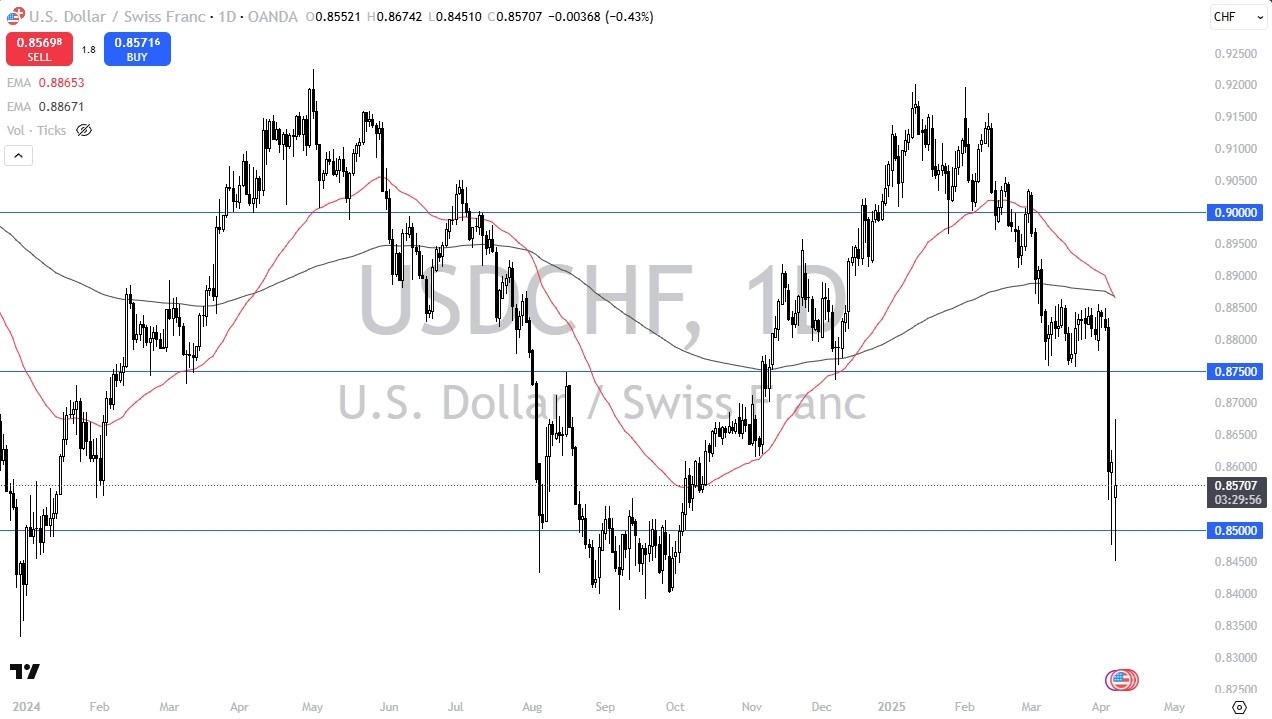

- The US dollar has been all over the place against the Swiss franc during trading on Monday, as spoofing of headlines has caused massive volatility.

- At one point during the trading session in New York, there was an exaggerated report about the idea that the United States might have a “90 day pause” on the tariffs going forward, and it lit the fuse for a lot of volatility in the market that was obviously melting down overall as traders worry about tariffs.

Safety Currencies

The interesting thing about this USD/CHF pair is that it features a couple of safety currencies, and other words places where people will run to if there are a lot of concerns. While the US dollar is considered to be a safety currency, you can say the same thing with the Swiss franc, as a lot of money will run toward Switzerland in times of chaos. We certainly are in a time of chaos, and that does make a certain amount of sense that the Swiss franc would remain somewhat attractive.

Top Forex Brokers

On the other hand, the market is at an extreme low, at least as far as risk appetite is concerned, so it does make a certain amount of sense that the Swiss franc will remain somewhat strong. At the same time, you can also make an argument that the Swiss National Bank will continue to be very loose with its monetary policy, and I think you’ve got a situation where that will continue to be the case. After all, nobody really knows how the tariff war is going to end, and therefore I would imagine quite a few Europeans are still throwing money into Switzerland in order to protect it.

The technical analysis in this pair is obviously very dire, but it is worth noting we are at least trying to hang on to the 0.85 level, an area that has been important multiple times, and therefore I think this area truly matters. On the other hand, if we do rally from here, the 0.8750 level will be yours short-term ceiling. The somewhat neutral candlestick for the day on Monday at least shows that we are attempting to stabilize at this point.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.