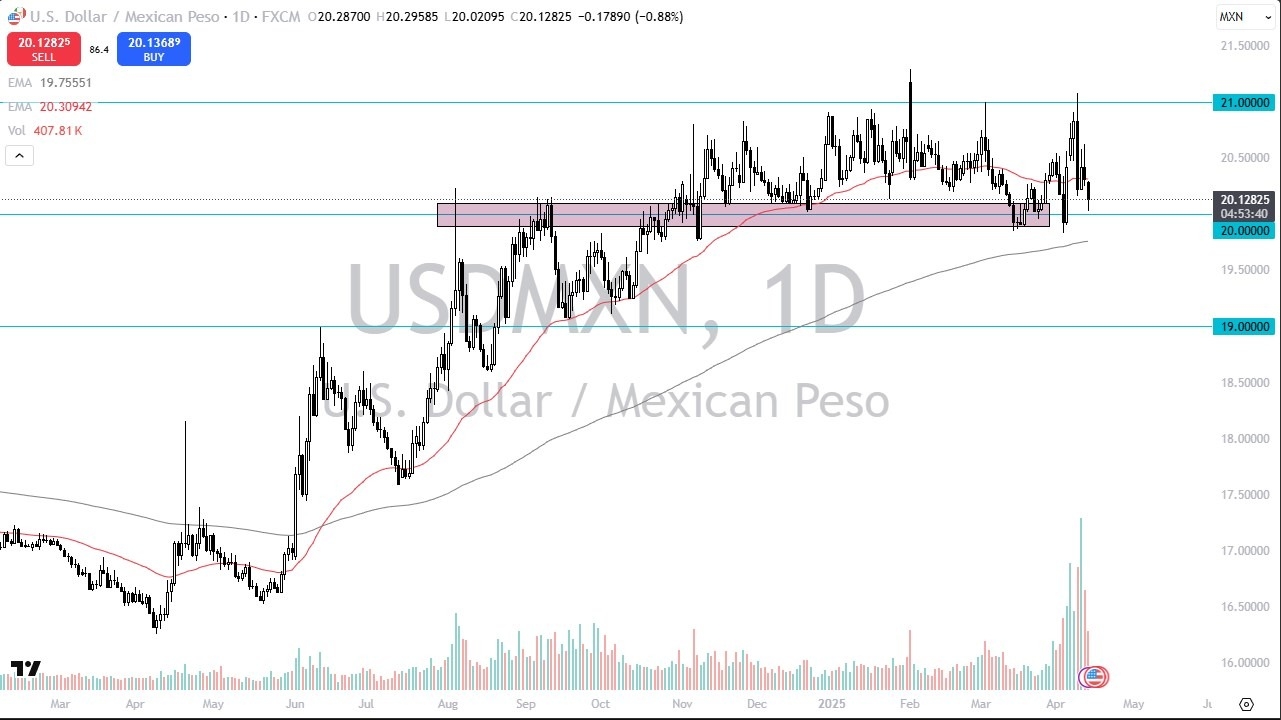

- The US dollar has fallen during the trading session on Monday against the Mexican peso, as we continue to test the 20 MXN level.

- This is an area that has been important multiple times, so it’s not surprising that we see the market testing this area yet again.

- If we were to break down below the 20 MXN level, then we have the 200 Day EMA underneath there offering a potential support level.

The market will continue to move on the latest tariff headlines and tweets coming out of White House, and you should also keep in mind that Mexico of course is going to be very sensitive to the US economy, which looks to be slowing down. If that ends up being the case, then any gains at the Mexican peso gets will probably be somewhat limited. That being said, move below that 200 Day EMA opens up the possibility of a move down to the 19 MXN level.

Top Forex Brokers

Continued Volatility

Regardless of what happens next, I think you continue to see a lot of volatility in this USD/MXN pair, which is not a huge surprise considering that the Mexican peso is an exotic currency, but we also have to keep in mind that the erratic behavior coming out of the White House as of late will continue to be very difficult for most traders to get a grip on. After all, the market is likely to continue to be noisy, but things stand right now we are still very much in a range between the 200 Day EMA and the crucial 21 MXN level. If we were to break above the 21 MXN level, that could lead to a massive spike higher.

On the other hand, if we break down toward the 19 MXN level, I would expect to see a lot of support in that area, especially as it would almost certainly signify more of a “risk on move”, which at this point it’s difficult to think that would have any real legs, at least as long as the US economy is going to be struggling.

Ready to trade our daily Forex forecast? Here’s a list of some of the top Mexican forex brokers to choose from.