Last month I wrote a piece about the FAANG stocks (Facebook, Amazon, Apple, Netflix and Google) which have led the great U.S. bull market in stocks over the past few years, arguing that Amazon and Netflix looked like strong buys. Since I published on 22nd February, Amazon is up by 6.89% and Netflix by 11.45%, which is a stellar performance for less than three weeks. The other three components are also up over the same period, as are the major market indices in general. Facebook is up by 3.4%, Apple by 5.85%, and Google by 4.12%. The S&P 500 Index is up by 2.73% and there is certainly a bull market in stocks which survives and runs on, even after the large, sharp correction which happened a few weeks ago.

Last month I wrote a piece about the FAANG stocks (Facebook, Amazon, Apple, Netflix and Google) which have led the great U.S. bull market in stocks over the past few years, arguing that Amazon and Netflix looked like strong buys. Since I published on 22nd February, Amazon is up by 6.89% and Netflix by 11.45%, which is a stellar performance for less than three weeks. The other three components are also up over the same period, as are the major market indices in general. Facebook is up by 3.4%, Apple by 5.85%, and Google by 4.12%. The S&P 500 Index is up by 2.73% and there is certainly a bull market in stocks which survives and runs on, even after the large, sharp correction which happened a few weeks ago.

One factor which made me most confident in Amazon and Netflix was the fact that the share prices of both these companies were making new all-time highs, which is often an excellent indicator for long stock trades when it is combined with the general momentum of the price over the recent multi-month period. As the Forex market has been relatively dull, certainly compared to the bull market in stocks, it is a good idea to ask yourself whether you should be trading stocks as well as Forex, as the opportunities to profit in bull markets are usually greater than opportunities in Forex. It is a well-known fact also that even when major Forex currency pairs trend, they travel less distance and move more slowly than stocks.

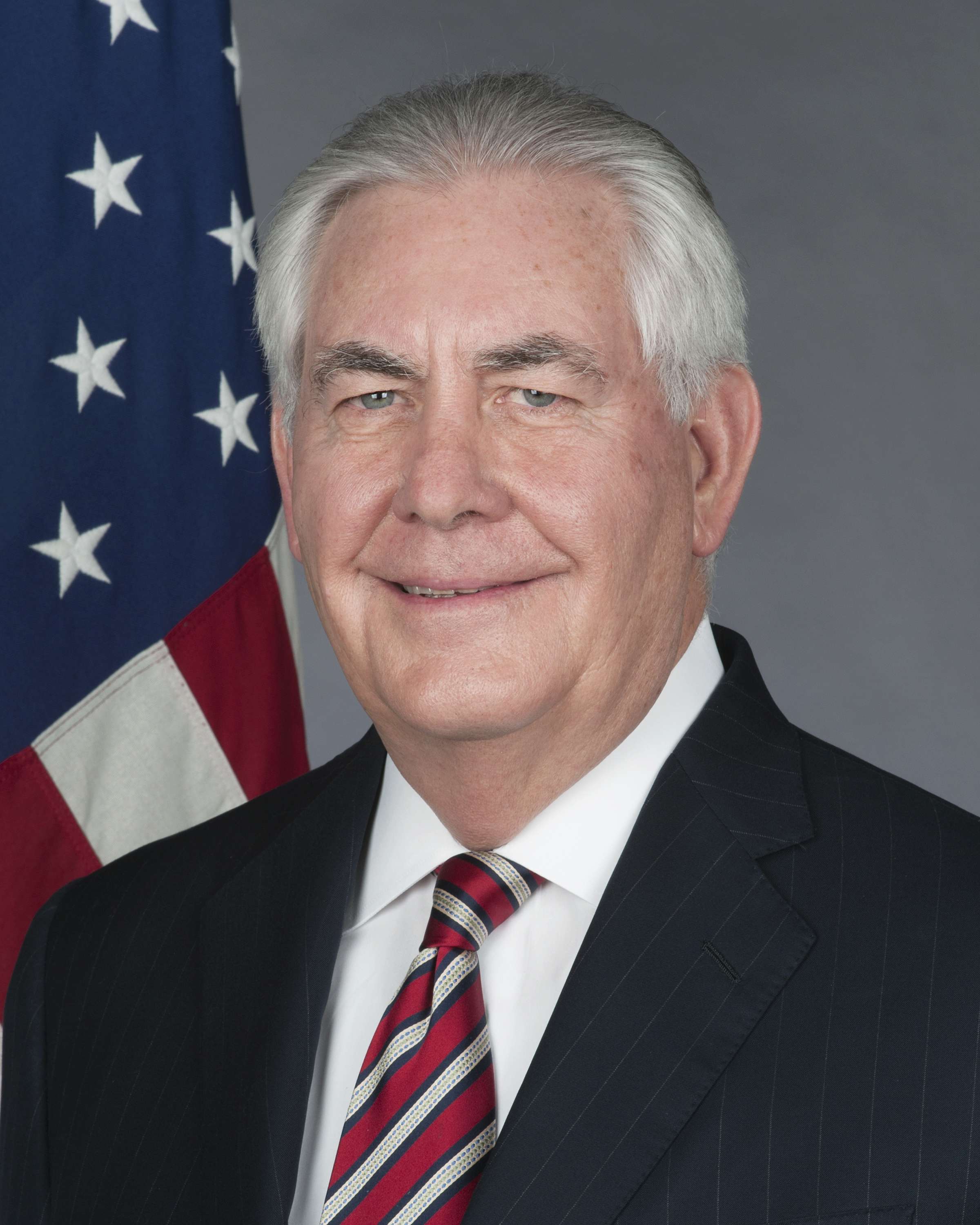

I spoke a little too soon about the dull Forex market: within the last hour news has come over that U.S. CPI (inflation) is increasing as expected at 0.2%, but the bigger item is President Trump’s firing of Rex Tillerson, his Secretary of State. The news is sending the U.S. Dollar lower everywhere and knocking the U.S. stock market too.