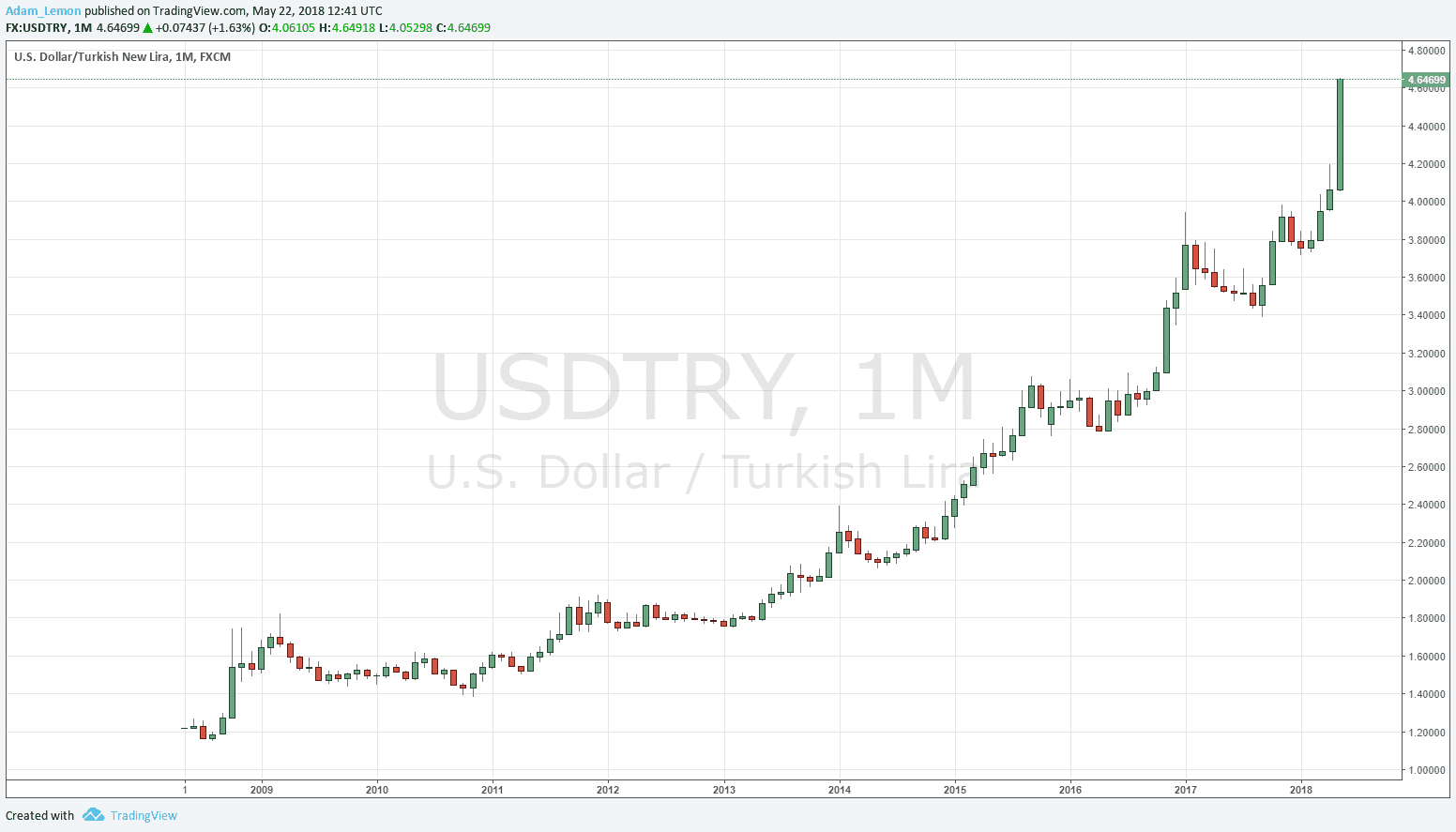

Have a look at the monthly chart below showing the U.S. Dollar against the Turkish Lira. You could use any currency as the counterpart to the Lira, you would see the same thing – a stunning, multi-year collapse in the value of Turkey’s currency, which has accelerated dramatically in recent months, especially over the last three weeks. Over the last 10 years, the U.S. Dollar has risen by about 250% against the Turkish Lira – that would be a wild return from a stock market, let alone the currency of a country of 80 million people with the 13th largest GDP in the world, and a founder member of the OECD and G-20.

This chart is the best example I have ever seen of the fact that truly exceptional directional price movement tells its own story – you do not need to be an economist to know that something is deeply wrong with a currency that depreciates like this. Fitch Ratings have published a good piece looking at the fundamental factors which are driving the recent sharp rise to new highs.

It would seem trend traders are well placed to profit here by being short of the Turkish Lira, but its not as simple as it looks for a few reasons:

Spreads are relatively large, equivalent to about 6 pips in a major currency pair such as EUR/USD.

Overnight financing rates are horrifically big: again, it is about the same being charged 6 pips per night on holding a position in EUR/USD. This means you really need to be sure that the price is very likely to rise by significantly more than that same amount, on average, EVERY SINGLE DAY to make holding the trade worthwhile.

The Turkish Central Bank will shortly come under the complete de facto control of the Turkish Presidency, which could take drastic and sudden steps to halt the rapid decline in the Lira. It is always difficult for a country to unilaterally strengthen its currency by decree, but you take a risk of something dramatic happening which could slip your trade far past its stop loss, especially over a weekend.

Day traders might also be interested in shorting the Turkish Lira while it is rising with such strong momentum, but they should be aware of the high volatility.