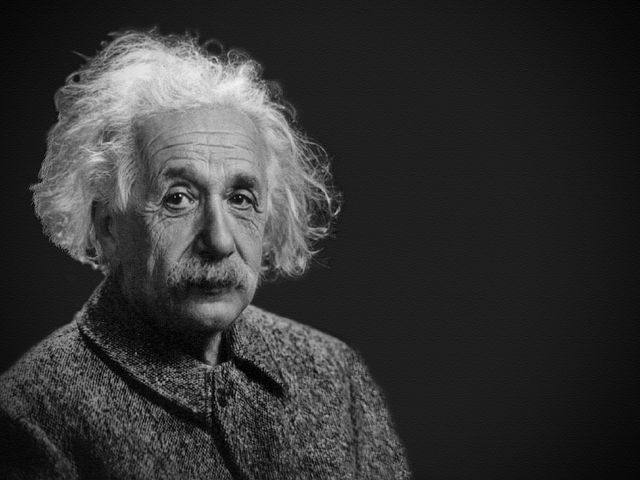

Albert Einstein once allegedly quipped (there is no reference to it anywhere for 23 years after his death) that compound interest is the eighth wonder of the world. The full quote: “Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it.”

Albert Einstein once allegedly quipped (there is no reference to it anywhere for 23 years after his death) that compound interest is the eighth wonder of the world. The full quote: “Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it.”

As I’ll explain shortly, the first sentence is correct, but its not immediately clear what is meant by the second sentence. He might have meant that anyone aware enough to understand the positive power of it would make sure to arrange their investments in a way that tried to incorporate a compounding money management method, while anyone not aware enough to understand its power would probably make purchases recklessly on credit. If you have a credit card, you are going to be paying compound interest at some point.

Here is a small example to illustrate the power of compounded money management. This is just an example, not a recommended strategy. Imagine you have a trading account of $100. You risk every dollar in your account on each trade. You make ten winning trades in a row and on each trade, you exit for profit at twice the risk of the trade. How much money do you have at the end of those ten consecutive winning trades? You would have $102,400 which, in percentage terms, would be a profit of 1,024% on your original investment! Before you get too excited, consider the fact that your odds of pulling off ten consecutive winning trades at two to one would, randomly, equate to approximately 1 in 169,000.

A more useful and realistic example of the power of compounding goes like this. Let’s say there are 10 trades where 0.20% profit is made on every trade with 1% of equity risked each time – a very good result for any trader. Due to the continuous positive compounding, this trader ends the series of trades with a total gain of 4.62%.

Now let’s imagine another series of 10 trades where an average of 0.20% is made on each trade, but all the profit comes on the final trade after 9 consecutive losses. Due to the continuous negative compounding, after the first 9 losing trades out trader is down by -8.65%. Then the final trade is a huge winner, coming in at a positive reward to risk ratio of 11 to 1! Yet at the end, this second trader has an overall profit of only 1.40%.

Now you can see why a higher win rate can be so helpful to overall profits, you can understand why stop losses can be very helpful when they are used properly – to prevent catastrophic huge single losing trades.