FXCC Editor’s Verdict

FXCC shines with a low-cost, commission-free trading account and excellent order execution. The core MT4 trading platform and balanced asset selection form the core trading environment. Beginner traders benefit from quality education, research, and a generous welcome bonus. High leverage and the free VPS service appeals to algorithmic traders and scalpers. I conducted an in-depth review of FXCC to determine if it is a broker on your side, as it claims. Does FXCC provide a competitive edge?

Overview

With no minimum deposit, high leverage, and low trading costs, FXCC is ideal for beginner traders and demanding seasoned ones alike.

Headquarters | Cyprus |

|---|---|

Regulators | CySEC, VFSC |

Year Established | 2010 |

Execution Type(s) | ECN/STP, No Dealing Desk |

Minimum Deposit | $50 |

Trading Platform(s) | MetaTrader 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

FXCC is an ECN/STP broker regulated in Vanuatu and Cyprus, founded in 2010. It has won numerous awards since 2017 and offers traders the popular MT4 trading platform. All traders have access to minimum spreads of 0.0 pips with $0 trading commission and a maximum leverage of 1:500, except for EU-based traders who are confined to EU leverage restrictions. FXCC also provides in-house research to clients and delivers educational content to new traders. Deep liquidity pools make it an excellent choice for scalpers and automated traders with substantial portfolios.

FXCC Regulation and Security

The Vanuatu Financial Services Commission (VFSC) provides FXCC with a competitive regulatory environment for international clients. EEA-based traders manage their portfolios from a subsidiary that is authorized by the Cyprus Securities and Exchange Commission (CySEC). The Cyprus Investor Compensation Fund (ICF) protects retail trades in the event of insolvency up to €20,000. Client deposits remain segregated from corporate funds at both entities with leading international banks, but FXCC does not list them. Clients can find the provision in the Investment Services General Conditions PDF. FXCC has a clean regulatory track record and established itself as a secure and trustworthy broker.

FXCC has two operating subsidiaries, one authorized by the business-friendly VFSC and one by the CySEC, which operates under the globally least-competitive ESMA regulatory framework.

FXCC maintains a secure trading environment.

Trader remains protected by negative balance protection.

FXCC Fees

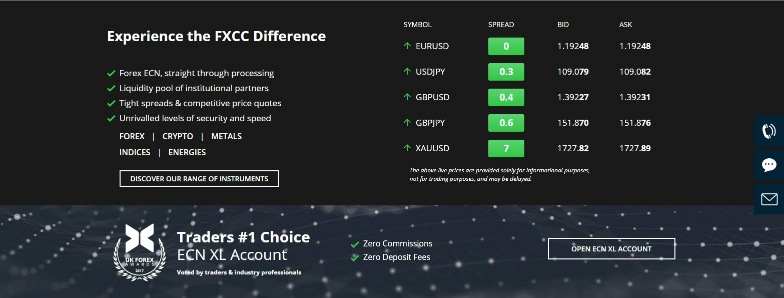

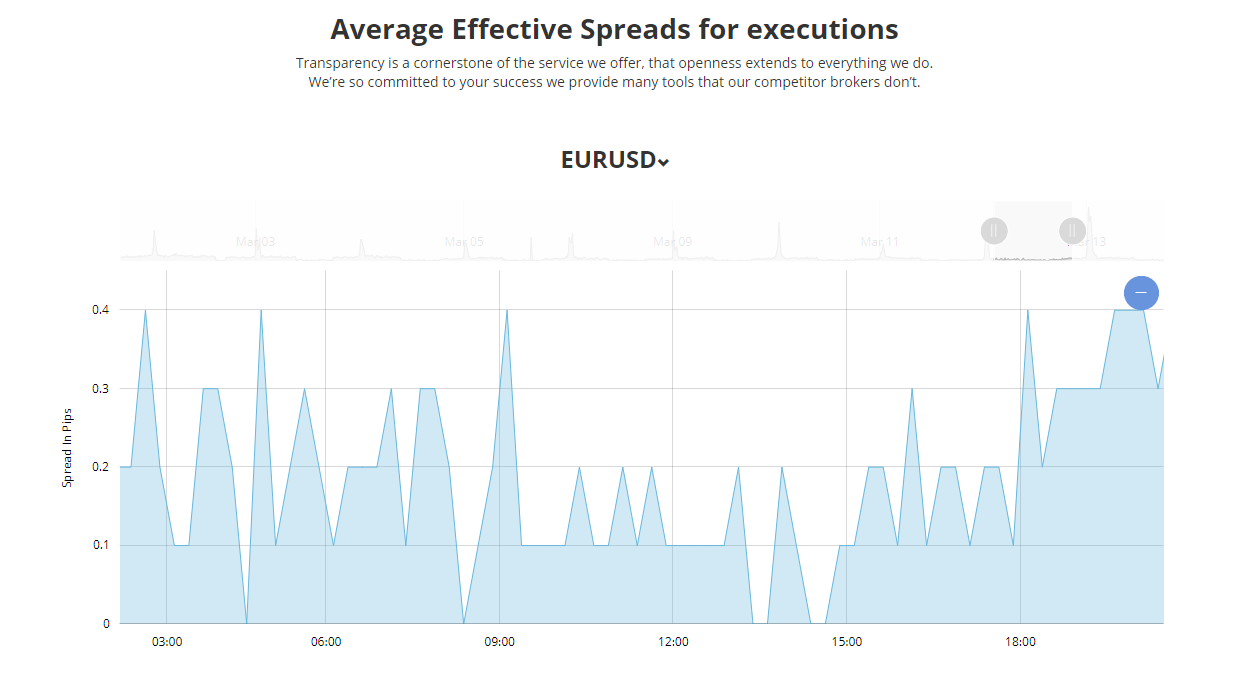

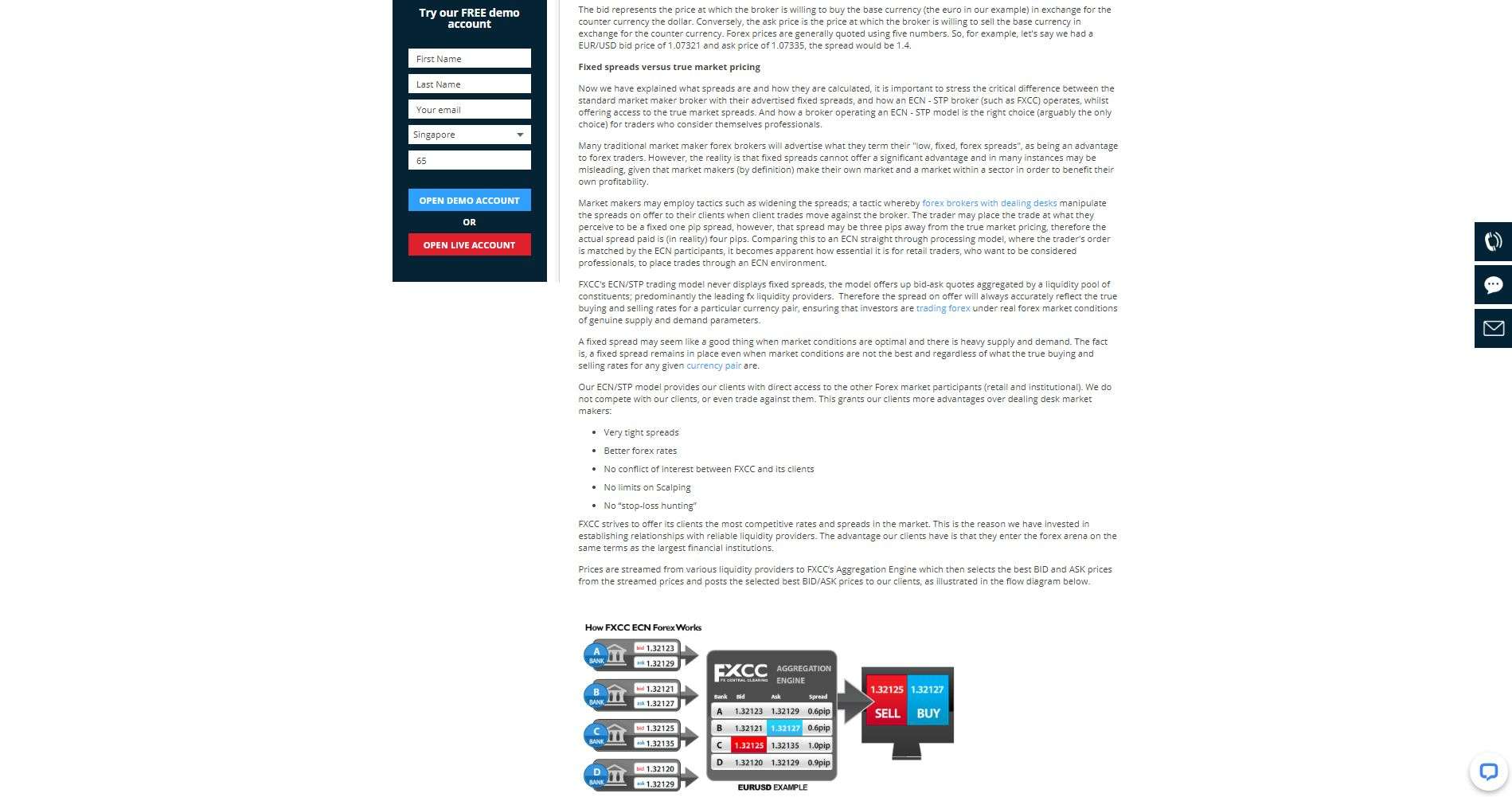

I rank trading costs among the most defining aspects when evaluating an exchange, as they directly impact profitability. FXCC offers traders a competitive commission-free trading environment. The EUR/USD spread ranges between 0.0 pips and 0.3 pips, with occasional spikes during the market news and trading session breaks, which FXCC transparently displays on its website. FXCC deploys an ECN/STP execution model and does not manipulate quotes.

Deposit Fee | Third-Party |

Withdrawal Fee | Yes + Third-Party |

Inactivity Fee | No |

Commissions / Spreads | Commission-free / 0.0 pips minimum |

Withdrawal Options | Bank wires, credit/debit cards, e-wallets, crypto |

Deposit Options | Bank wires, credit/debit cards, e-wallets, crypto |

FXCC maintains one of the cheapest Forex cost structures available, with commission-free quotes from 0.0 pips or $0.00 per 1.0 standard lot for the most liquid currency pairs like the EUR/USD and the USD/JPY. The average spread for major currency pairs is below 0.5 pips or less than $5.00 per lot, offering traders a distinct pricing environment advantage.

The minimum trading costs for the EUR/USD in the ECN XL account at FXCC:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

0.0 pips | $0.00 | $0.00 |

The average trading costs for the EUR/USD in the ECN XL account at FXCC:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

0.2 pips | $0.00 | $2.00 |

Here is a screenshot of the FXCC quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

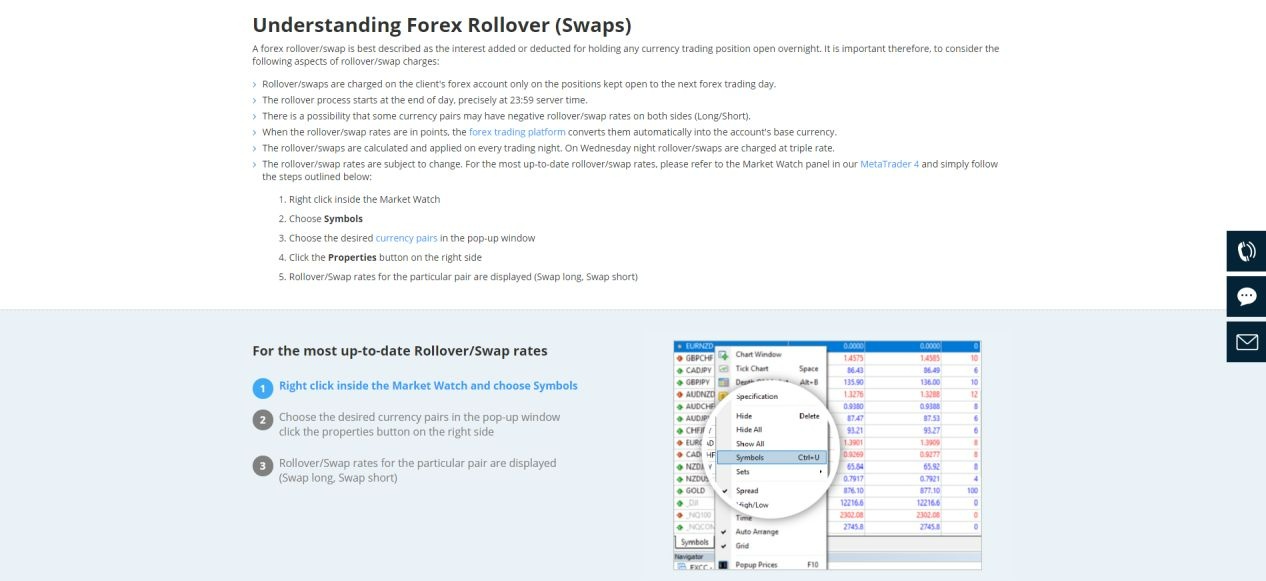

Swap Rates

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs. FXCC shows clients how to obtain the most up-to-date rates, a step many brokers omit.

Noteworthy:

- FXCC offers a positive swap on qualifying short positions, where traders get paid money to hold trades overnight

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the ECN XL account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

0.0 pips | $0.00 | -$6.142 | X | $6.142 |

0.0 pips | $0.00 | X | $2.781 | -$2.781 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

0.0 pips | $0.00 | -$42.994 | X | $42.994 |

0.0 pips | $0.00 | X | $19.467 | -$19.467 |

FXCC Leverage

FXCC offers maximum Forex, commodity, and indices leverage of 1:500 through its Vanuatu branch. Cryptocurrency traders there get 1:40 on Bitcoin and 1:10 for all other cryptocurrency pairs. It is a highly competitive offer, providing traders with an edge, ideal for demanding traders who understand how to use risk management. Negative balance protection exists, ensuring traders cannot lose more than their deposit. FXCC’s offering though its Cyprus branch is necessarily lower on maximum leverage, due to local law, with maximum Forex leverage capped at 1:30.

The pricing environment at FXCC is competitive.

FXCC provides data on average effective spreads.

Quotes remain sourced from multiple liquidity providers and matched for the best possible execution.

FXCC informs clients on how to access swap rates.

Currency conversion mark-ups may apply.

.jpg)

What Can I Trade?

FXCC lists 71 currency pairs, 12 cryptocurrency pairs, 12 indices, spot metals and commodities, like WTI and Brent. Overall, the asset selection is both impressive and more than ample for new and intermediate traders.

FXCC Trading Hours (GMT +2)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Forex | Monday 00:05 | Friday 23:55 |

Commodities | Monday 01:00 | Friday 23:55 |

European Equities | Not applicable | Not applicable |

US Equities | Not applicable | Not applicable |

Noteworthy

- While FXCC does not offer equity trading, it maintains a dozen index CFDs

- US index CFDs trade from Monday through Friday, 01:00 to 24:00

- UK index CFDs trade from Monday through Friday, 03:00 to 23:00

- European index CFDs trade from Monday through Friday, 09:00 to 23:00

- Asian index CFDs trade from Monday through Friday, varying times

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

FXCC Account Types

At the time this review was written, FXCC only offered a single account type: its commission-free trading ECN XL account. I like this equal treatment regardless of deposit size.

My observations concerning the FXCC ECN XL account:

- There is no minimum deposit for this account, offering traders freedom and flexibility in growing their portfolios

- The maximum leverage is 1:500, and the stop-out level is 50%

- Negative balance protection applies

- There is no minimum stop loss distance

- As the name suggests, FXCC deploys ECN execution, ideal for scalpers and other high-frequency, high-volume traders

- Traders can place orders with volumes as low as 0.01 lots

- FXCC has no restrictions on trading strategies, including scalping, hedging, and news trading

- Algorithmic trading is also supported, or EAs as MT4 classifies it, plus qualifying traders get access to free VPS hosting

- The server locations are in New York, London, Germany, and Hong Kong

- Available account base currencies are the US Dollar, the Euro, and the British Pound

- A swap-free Islamic account exits by request

Noteworthy:

- The FXCC ECN XL account ranks among the most competitive industry-wide

- Traders can get commission-free raw spreads of 0 pips with an average of 0.5 pips, which results in the cheapest cost structure available, ideal for high-volume traders

FXCC Demo Account

FXCC offers demo accounts, apparently without any time limit, making them ideal for testing algorithmic trading solutions and new strategies. I want to caution beginner traders against using a demo account as an educational tool. It creates unrealistic trading expectations, and the absence of trading psychology negates the educational value.

My recommendation:

- MT4 offer flexible deposits, and traders should select a nominal amount equal to what they plan to deposit into a live trading account

FXCC Trading Platforms

Clients have access to the full suite of the out-of-the-box MT4 trading platform. It fully supports automated trading and is one of the most versatile trading platforms available. MT4 upgrades are available through third-parties for an additional fee to (potentially) enhance the trading experience. One significant advantage is that FXCC offers a more in-depth introduction to MT4, which many brokers fail to do, and which can truly set traders up for longer-term success.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

FXCC offers traders the core MT4 trading platform without third-party upgrades.

.jpg)

Unique Features

FXCC advertises free VPS, supporting automated trading solutions. The service provider is BeeksFX, but FXCC clients must have a minimum account balance of $2,500 and a monthly trading volume of 30 standard lots. Otherwise, the service costs $30 per month.

A VPS service by BeeksFX is available at FXCC.

Terms and conditions apply to receive it for free as advertised, but all the information is fully transparent and easy to understand.

Research And Education

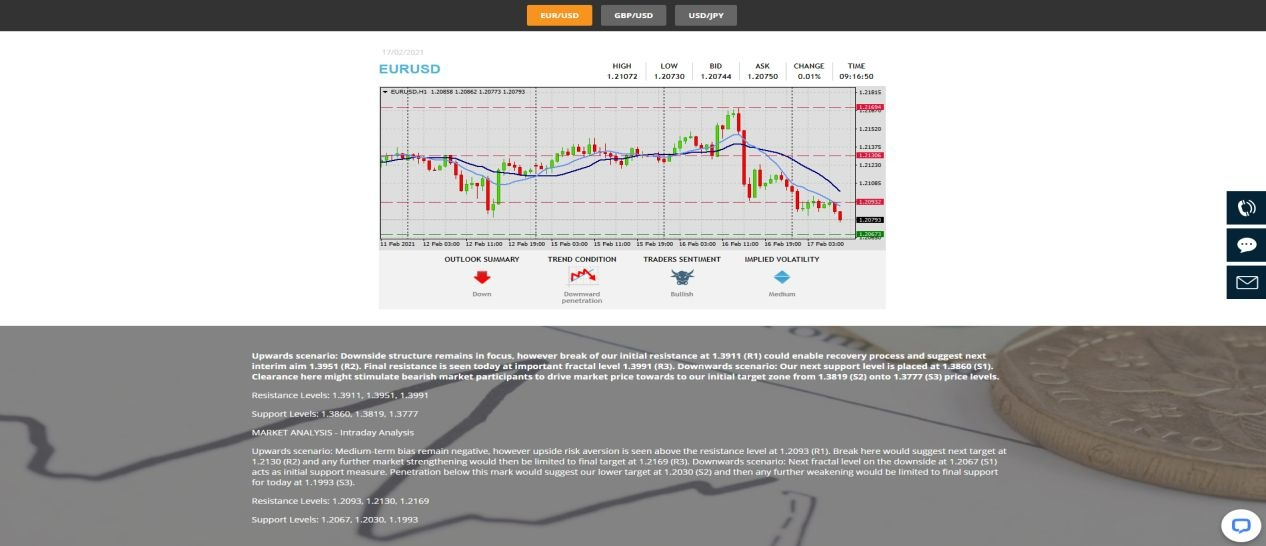

FXCC provides clients with daily technical analysis for the EUR/USD, GBP/USD, and USD/JPY. While each analysis is brief, it features all required information for traders to take a position. The signals remain well-presented. It also maintains a blog where it publishes market-related content, but the Forex News section does show wide gaps between its posts. With such a useful market analysis, we would love to see the section expanded to other pairs.

FXCC provides in-house research on three popular currency pairs.

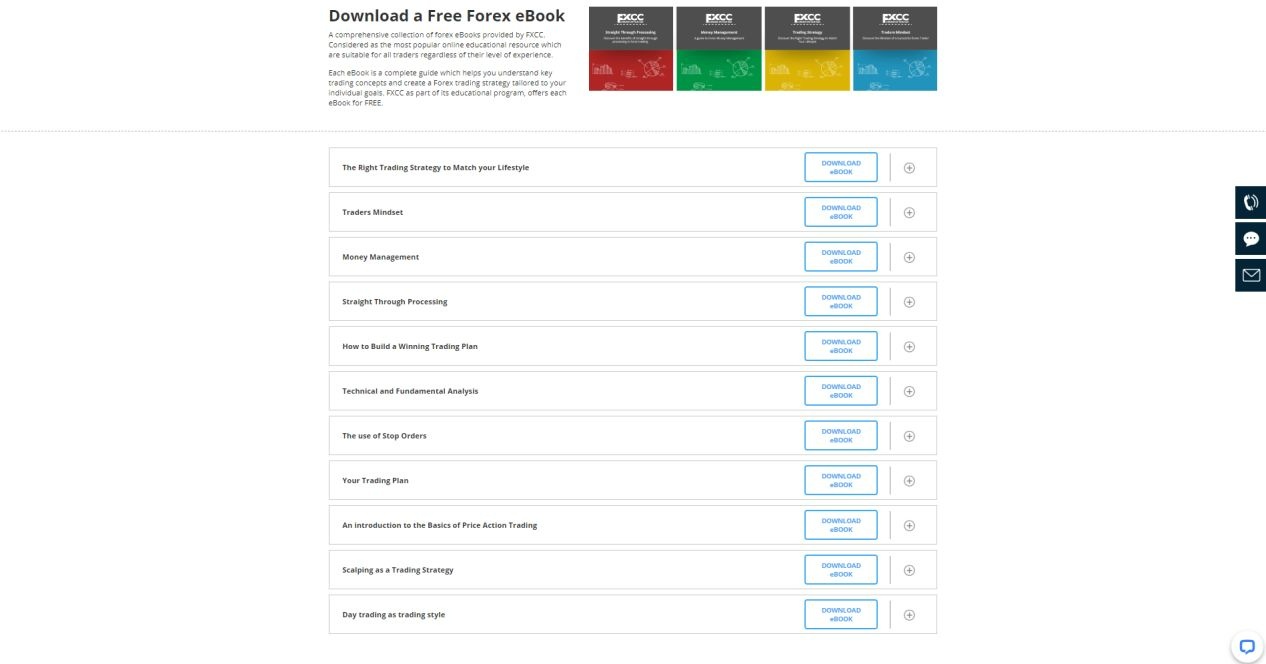

New traders have access to fourteen quality educational posts plus a dedicated section on major economic reports. Eleven eBooks complete the education at FXCC, and the overall product remains impressive. Five MT4 user guides and a Forex glossary section are also available. FXCC offers beginner traders a sound educational offering from where traders can expand. While an interactive course or videos are not available, the existing content provides a well-thought-through introduction to trading.

The Education Center features six articles and five user guides.

New traders should start with the eight Forex Basics articles.

FXCC briefly explains fourteen economic indicators.

.jpg)

Eleven eBooks add value to the overall FXCC educational section.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |          |

Customer support is available 24/5 via e-mail, webform, phone, fax, and live chat. FXCC also has seven social media channels. The FAQ section answers many of the most common questions, and FXCC is transparent about its products and services. Most traders are unlikely to require additional assistance unless of an emergency. FXCC ensures swift access to all clients who need support.

FXCC provides 24/5 customer support to clients.

Bonuses and Promotions

While an FXCC no deposit bonus does not exist, FXCC offers a 100% first deposit bonus with a $2,000 limit. Terms and conditions apply, and I urge traders to read and understand them before accepting the incentive. FXCC occasionally introduces other bonuses and promotions, which have included a $50 FXCC no deposit bonus or annual interest on free margin.

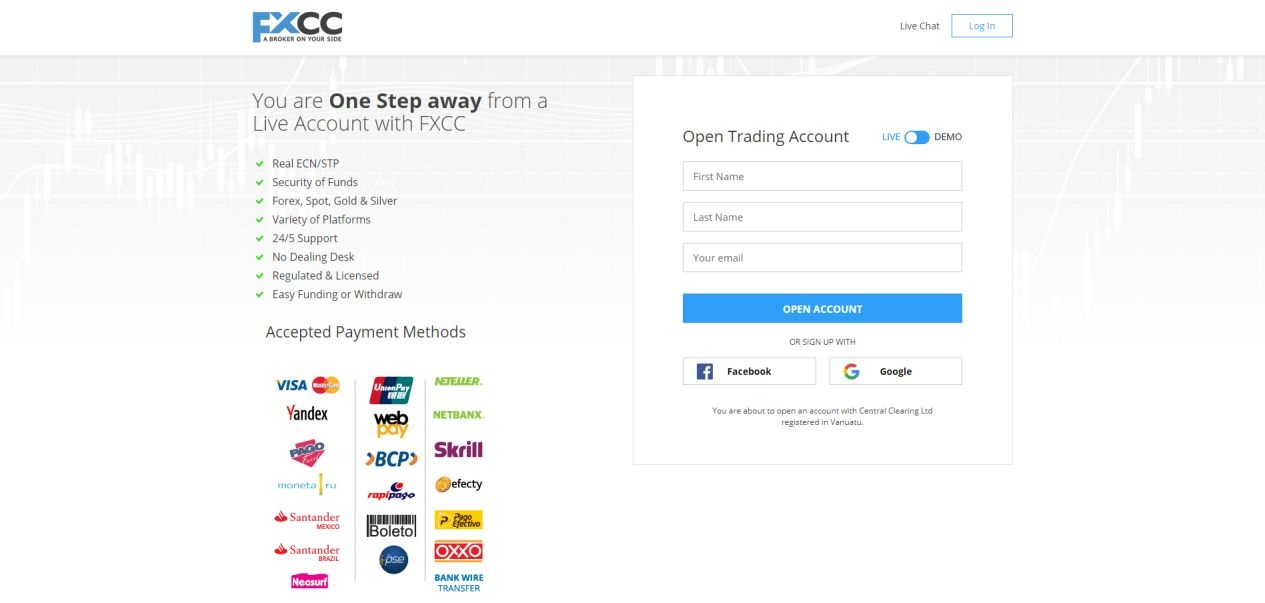

Opening an Account

The swift online application at FXCC requires a name and e-mail. Clients may also use their Facebook or Google accounts to open an account. Since FXCC is a regulated and fully compliant broker, new traders must pass account verification per AML/KYC stipulations. A copy of the ID and one proof of residency documents usually satisfies this final step.

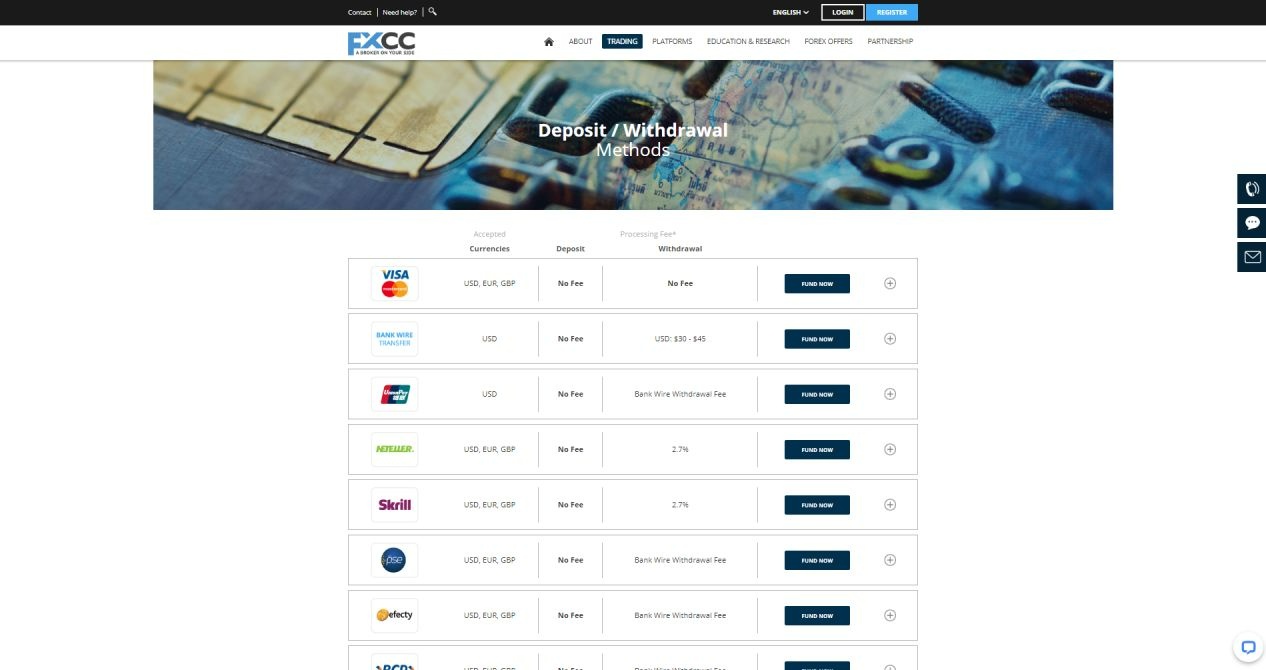

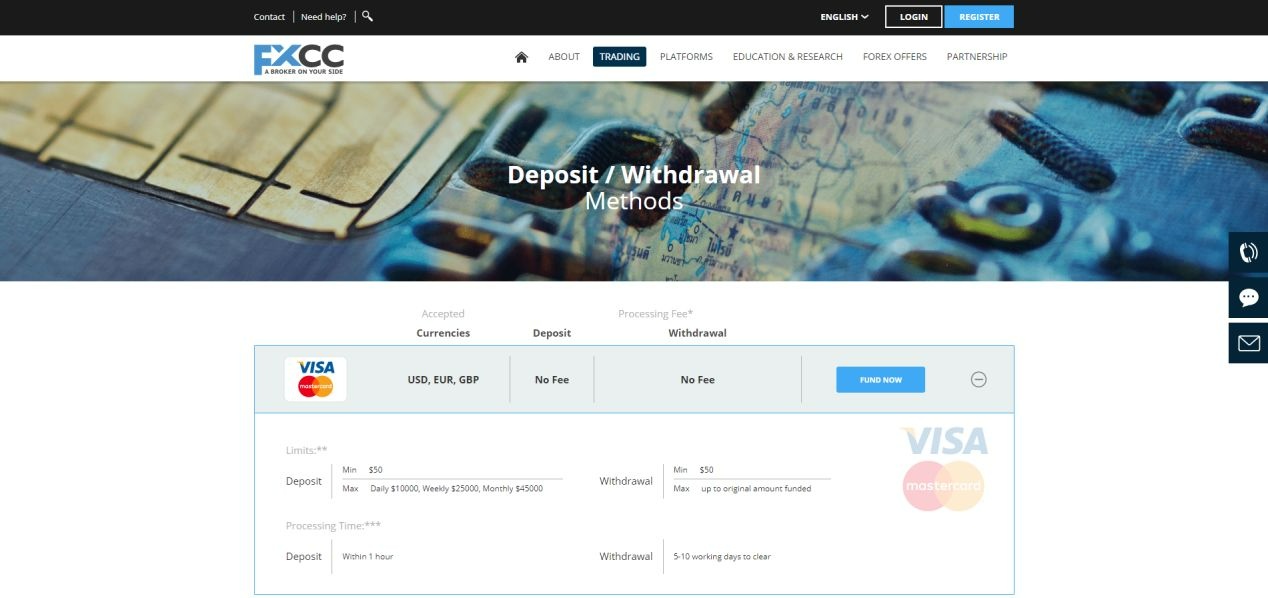

FXCC Deposits and Withdrawals

FXCC supports bank wires, including several local options, credit/debit cards, UnionPay, Neteller, and Skrill. Traders can access the processing times and minimum/maximum deposits by clicking on the + next to each option. FXCC transparently provides all necessary information on its website. There are no deposit fees, but several withdrawals face internal charges while third-party processor costs may also apply.

Traders have access to numerous deposit and withdrawal options at FXCC.

FXCC remains fully transparent about the process.

Summary

FXCC deploys an excellent ECN/STP/NDD execution model with access to numerous liquidity providers. The commission-free trading environment features competitive average spreads, . There are no restrictions on trading strategies, and new traders have access to a valuable educational section. There is no minimum deposit with a maximum leverage of 1:500 for all non-EU traders. FXCC has a competitive core from where it can expand its reach with a few adjustments to its existing business approach.

FAQs

Is FXCC a scam?

No, FXCC is a legit broker with regulatory oversight from the VFSC and the CySEC.

What is FXCC?

FXCC is a multi-asset broker with two subsidiaries. One operates out of Vanuatu, where international clients have a trustworthy and competitive trading environment. FXCC also maintains a presence in Cyprus for EU-based clients under the uncompetitive ESMA regulatory framework.

Is FXCC safe?

Yes, FXCC follows all regulatory requirements. It maintains sufficient capital reserves, segregates client deposits from corporate funds, offers negative balance protection, and undergoes audits.

Is FXCC a good broker?

The overall trading environment at FXCC features a low cost structure and competitive asset selection, . While the execution model is excellent. FXCC lacks more trading tools, like CFDs on stocks for example, which became so popular recent days.

How do I open an account with FXCC?

A swift online application handles new accounts.

Is FXCC regulated?

FXCC holds a regulatory license from the Cyprus Securities and Exchange Commission (CySEC). It also operates an unregulated but duly registered subsidiary in Vanuatu, where most international clients trade.

How do I withdraw money from FXCC?

The secure back office of FXCC handles all financial transactions. Only verified accounts may request withdrawals. FXCC maintains a nice balance of traditional payment processors like bank wires or credit/debit cards, modern e-wallets like Skrill or UnionPay, and cryptocurrencies.

Is FXCC an ECN broker?

FXCC is an ECN broker and only maintains one ECN account for all clients. It is unique as traders get a commission-free cost structure with raw spreads, an unusual offer, presenting Forex traders with a notable edge.