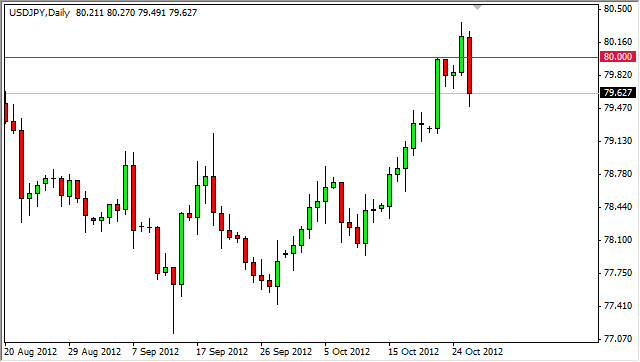

The USD/JPY pair fell precipitously on Friday in order to confirm the 80 handle as massive resistance. The area has been a cap on the price of this currency pair for some time now, and as a result we have seen the sellers come in and step up the pressure every time the buyers have had a chance to break out.

The Bank of Japan certainly is looking to weaken the Yen, but the truth is that the Federal Reserve has a much bigger printing press. The Bank of Japan is set to announce another round of quantitative easing this coming week, and the reaction will more than likely be the same as we have seen before: The knee-jerk reaction will cause a spike in this pair, but in the end we will fail to hold onto gains.

One of the biggest reasons I believe that we won’t hold onto any gains is the fact that the weekly candle is a shooting star. This is of course a very bearish turn of events, and should catch the attention of everyone in the markets. When the sharks smell blood – they will all jump in at once. Also, this has been the most reliable trade in Forex for several months now…..certainly people will not have forgotten this.

Shooting star at the right place

The shooting star on the weekly chart couldn’t be placed at a better spot. In fact, the 80 handle has been like a brick wall for months, and I believe the resistance extends all the way to the 80.50 level based upon the attempted breakout previously.

The 80.50 level will be crucial though – especially if we somehow get above it. If that does happen, then we enter a new phase that sends this pair all the way to the 84 handle before hitting serious resistance. Above there and it is a buy-and-hold market, much like we saw for a few years in the housing bubble. The candle for the Friday session shows a serious backlash against the buyers, and as a result I think this move to retrace the gains over the last couple of weeks has already started.