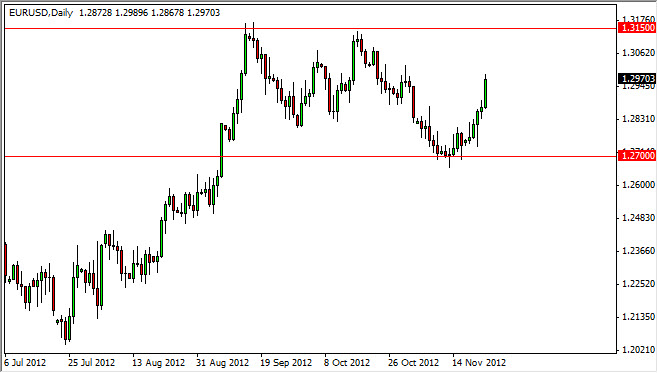

The EUR/USD pair continued to show strength as the Friday session solid rise above the 1.29 level significantly. We are now approaching the 1.30 level, and we've already proven that the 1.3150 level is the true resistance area that buyers will have to be aware of.

Because of this, it does appear that the upside is somewhat limited, but the reality is that the bounce has been quite strong. The real question is whether or not we will be able to get over the 1.350 level, which of course is something that I am not certain about one way or the other.

Looking forward, it really will come down to whether or not traders are focusing about the trouble in Europe, or the trouble in the United States. This is essentially a barometer on where people were concerned about at the moment, and as such is headline driven to say the least. In fact, this pair is much more headline driven than I can remember over the last several years.

Sideways consolidation?

If I have a base case for December, it would be that we are getting ready to head into a sideways consolidation move. This would make sense, as the volumes dry up in the month of December and the markets really haven't made a decision one way or the other, despite the recent bullishness.

The headlines will move this pair from time to time, but the reality is that we have been trading in a 450 pip range for the last four months. Once we get closer to the Christmas holiday, the lack of liquidity could send this pair going back and forth quite a bit, but until then I really don't see any moves. I think this is going be more or less a short-term traders market, and I do have to admit that has an upward bias for the moment. However, I would not hesitate to sell any weak candles once we get a little bit higher as I see that resistance is far too strong for the buyers to overcome.