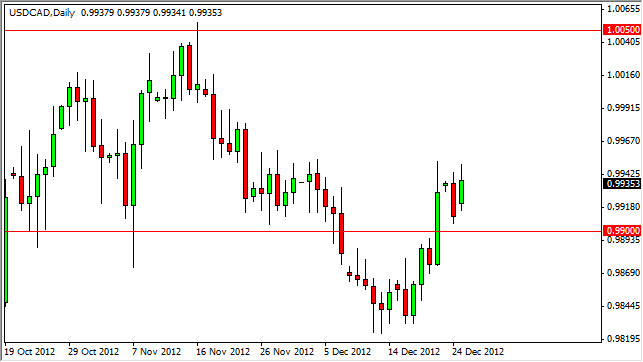

The USD/CAD pair managed to plow higher during the session on Wednesday after traders came back from the Christmas holiday. However, we did manage to break above the 0.9950 level, so as far as I can see we are still consolidating. Because of this, there isn't much of a trade at the moment in my opinion.

However, I believe that the 0.9950 level will be crucially important going forward. This is predicated upon the idea that the “fiscal cliff” is going to continue to have a massive effect on this pair going forward. I think that if we managed to break above the 0.9950 level it will be because of fear, and few signs of anything good coming out of those discussions.

Looking at the present situation, it's easy to think that we will essentially do nothing until the end of the year. After all, we do see that resistance mentioned above at the 0.9950 level, but we also have significant support at the 0.9800 level. Because of this, I believe that we will more than likely drift lower, but could see a little bit of support at the 0.99 handle.

Snoozefest?

It's very possible that this pair does little during the next couple of sessions. If you are a little more aggressive, you can go ahead and sell at this point, expecting the 0.9950 level would continue to hold as resistance. However, I am aware the fact that the low look would he could cause a massive move in one direction or the other, especially when we are talking about the potential headlines coming out of Washington DC.

I believe that if we managed to break down below the 0.99 level, that we could see a move down to the 0.98 handle in relatively short order. Below there, we would more than likely see a move to the 0.95 handle over the next month or two. Ultimately, I believe that the fiscal talks will produce some type of resolution and that this pair will continue lower. However, it could be a while before we see that and there's also the possibility that some type of negative headline sends this pair skyrocketing in the process. Because of this, I believe that great care should be taken and stop losses be kept relatively tight.