By: DailyForex.com

Last Monday I ended my analysis on this pair as follows:

1. The general outlook is bearish, with a retrace back towards the bullish trend line visible on the weekly chart, now sitting at about 1.0175.

2. There is a zone of overhead resistance from about 1.0420 to 1.0450.

3. There seems to be support above last week's low of 1.0325.

4. A rise up to 1.0420 during the next few days will present a good opportunity to look for short trades. A logical target is 1.0325 but be cautious and consider taking at least some profit once the price hits 1.0375.

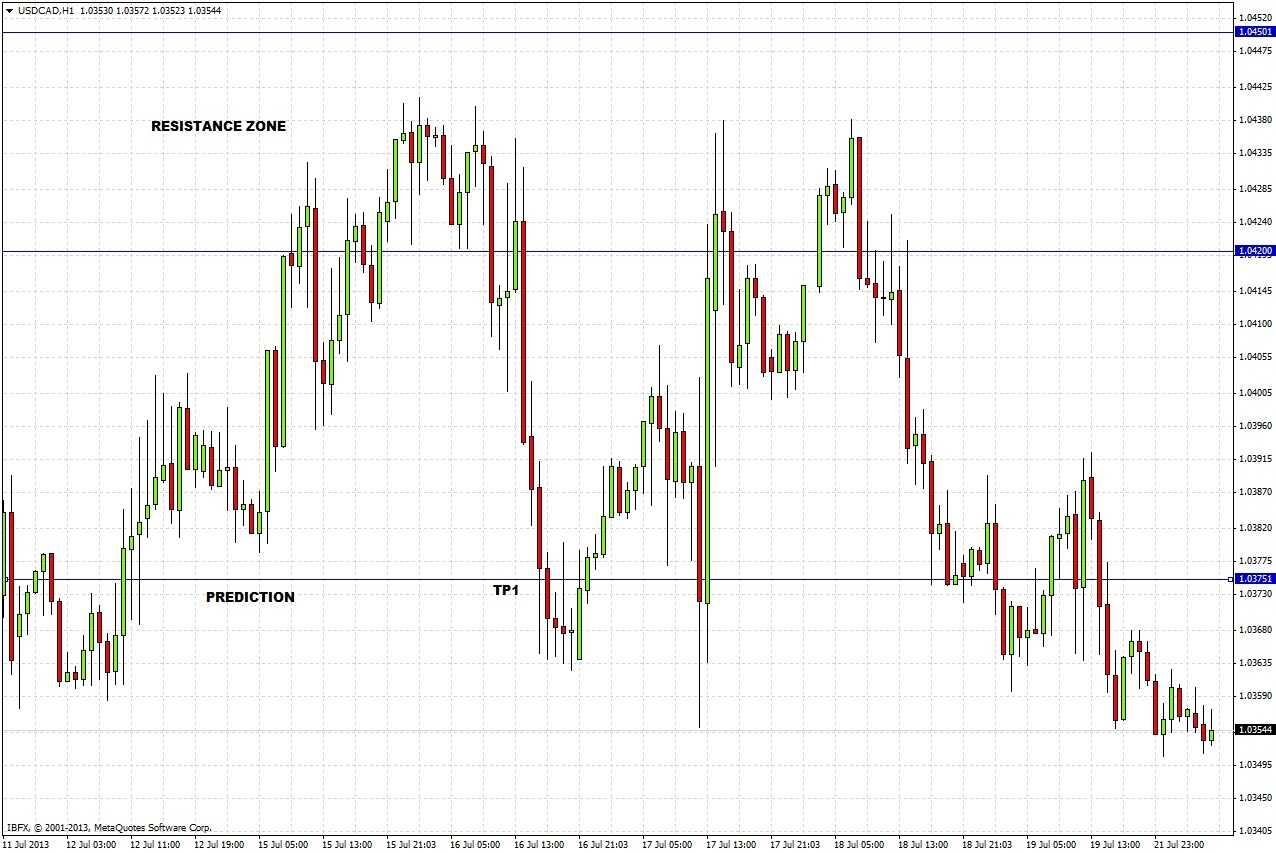

My prediction worked out very well, as can be seen from the hourly chart over the past week:

Twice the price rose into the resistance zone above 1.0420 then fell to hit the first profit target of 1.0375. Currently the price is still falling, and is around the level of last week's low.

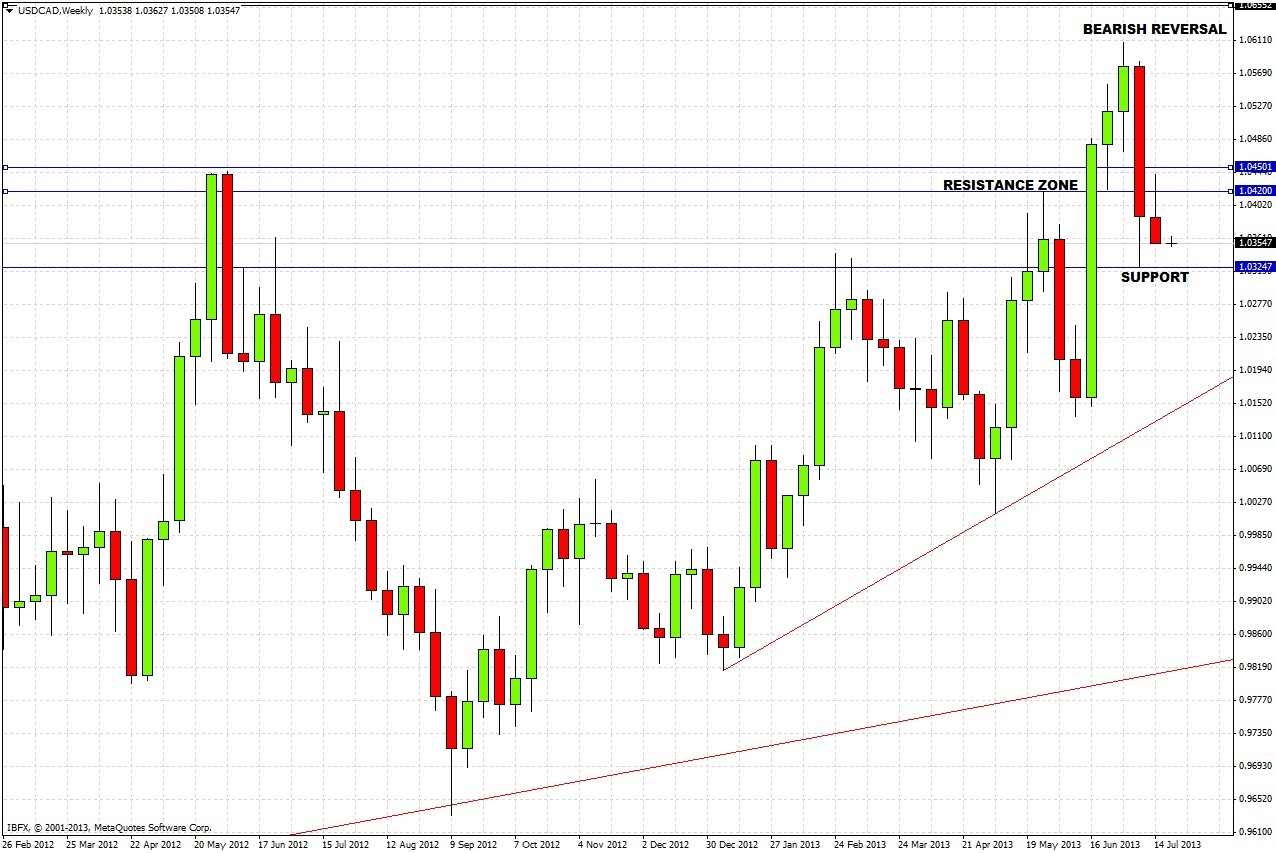

The weekly chart shows we are in a downtrend, but within a longer-term uptrend:

The week before last was a bearish reversal, price also fell last week. We are approaching support at 1.0325, and let us not forget that below is are not only levels that saw plenty of buying but also a bullish weekly trend line sitting at about 1.0125 and a bullish monthly trend line far below. So we really need to take a close look at the daily chart to see how bearish it might be wise to be.

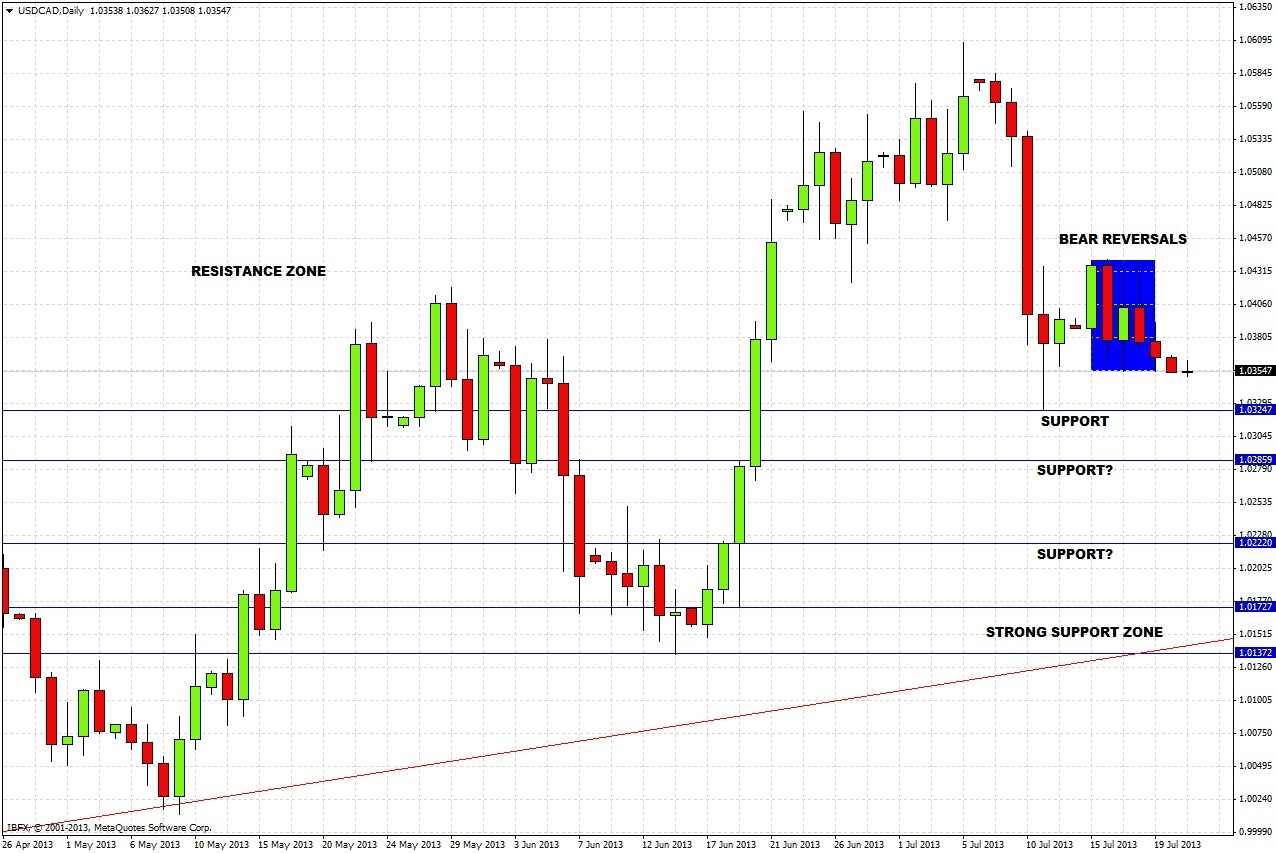

The chart shows there were two bearish reversals last week.

All the signs point to a continued fall to at least 1.0325, and possibly beyond that. In the chart above I have marked possible support levels at 1.0286, 1.0222, and a strong support zone between 1.0172 to 1.1037 coinciding with the lower weekly bullish trend line. This zone needs to be broken decisively before we can hold a long-term bearish bias. However in the next few days, until we get a strong reversal at one of these support levels, it should be wiser to remain bearish and look for shorts. Be cautious as the zone below 1.0325 was previously an area of strong buying. The support lines identified should incur caution when the price is close to them.