Our analysis one and a half weeks ago concluded with:

"No doubt about it, the uptrend is intact. Logically there should be more to be made on the long side, so the question should be where to look to go long. The advice from last week still stands: wait for a bullish reversal when price reaches 1.0444, or even earlier in the buy zone identified in the hourly chart above. If it never comes and the price falls through 1.0440, wait for the price to stabilise somewhere from 1.0368 to the bullish trend line some pips below that, which looks like a great buy zone.

If we get to last week's high at 1.0567, or even close to it with weak momentum, this is a good area to take long profits and to look for a counter-trend short trade if you want."

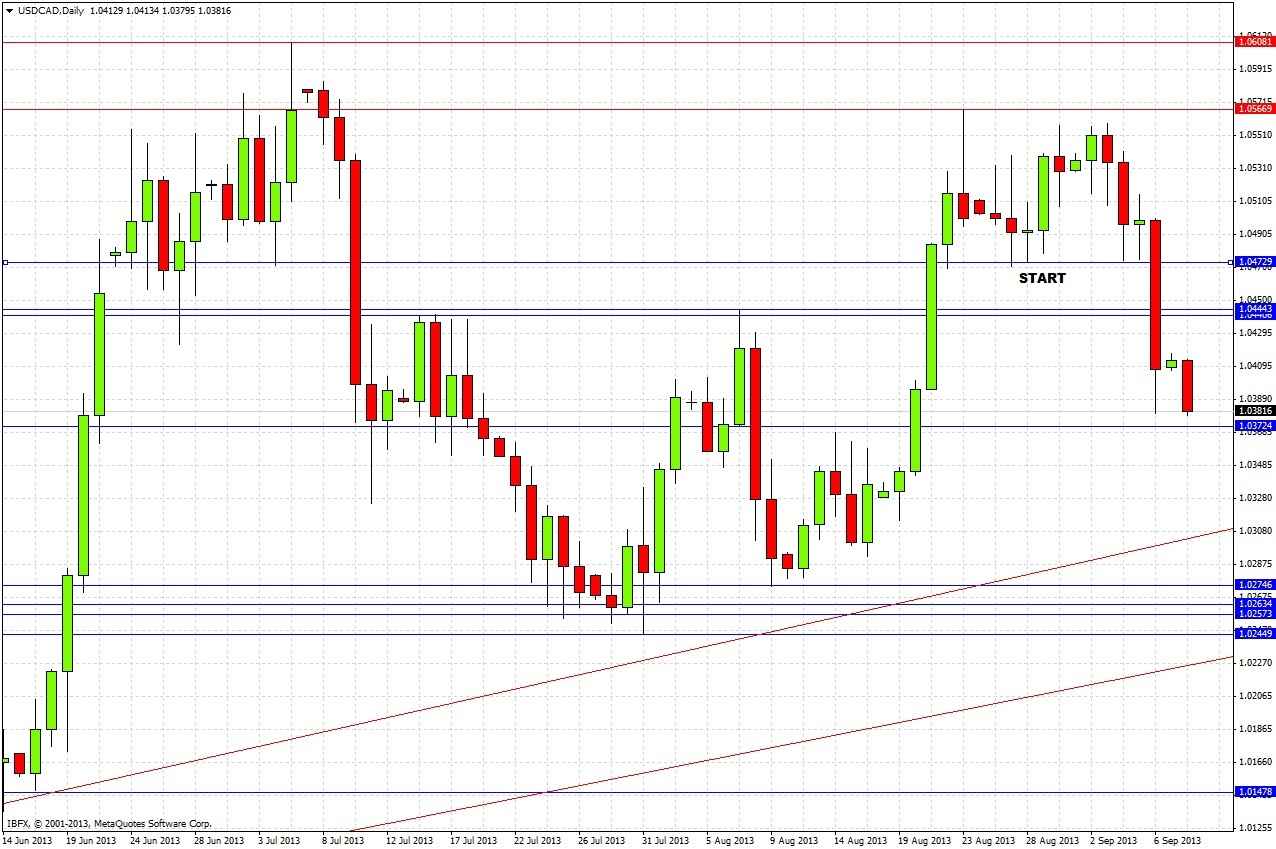

Let's look at the daily chart since then to see how things turned out

Last Tuesday, the price reached within 10 pips of the previous week's high after the bullish momentum had begun to stall, ultimately forming a bearish reversal candle. It had a long lower wick, but it was still a reversal and therefore adequate for a short which would be nicely profitable by now. So the short part of the last forecast worked out pretty well.

As for the support levels, the buy zone identified from 1.0475 was good for a few long bounces, it held as good support for several days. However, regarding the lower support at 1.0444, there was no bounce there when the level was first hit last Friday, in fact the price fell straight through. The price has not reached 1.0368 at the time of writing.

The biggest drawback with technical analysis is that it cannot account for dramatic news and/or sudden changes in sentiment. With the prospect of armed conflict in the Middle East, all currency pairs have the potential for sudden, strange and dramatic price action triggered by news or rumours. This pair is more susceptible than most, as CAD is highly positively correlated with the price of oil, which should jump sharply if armed conflict does break out in the coming days. The anticipation of such events has already caused a strengthening in oil and CAD.

While bearing these events in mind, it is still worth drawing a technical analysis, so let's start by looking at the monthly chart:

The chart gives a very conflicted picture and signifies a ranging market, with a bullish then a bearish reversal bar over the previous two months, and now the price has been heading downwards again.

Let's drop down to the weekly chart:

1. Last week was a bearish reversal, suggesting that there will now be a further fall, probably to the bullish trend line.

2. However, note that below this bearish reversal, we are entering an area of price that was covered by a bullish reversal that has not been broken to the downside yet.

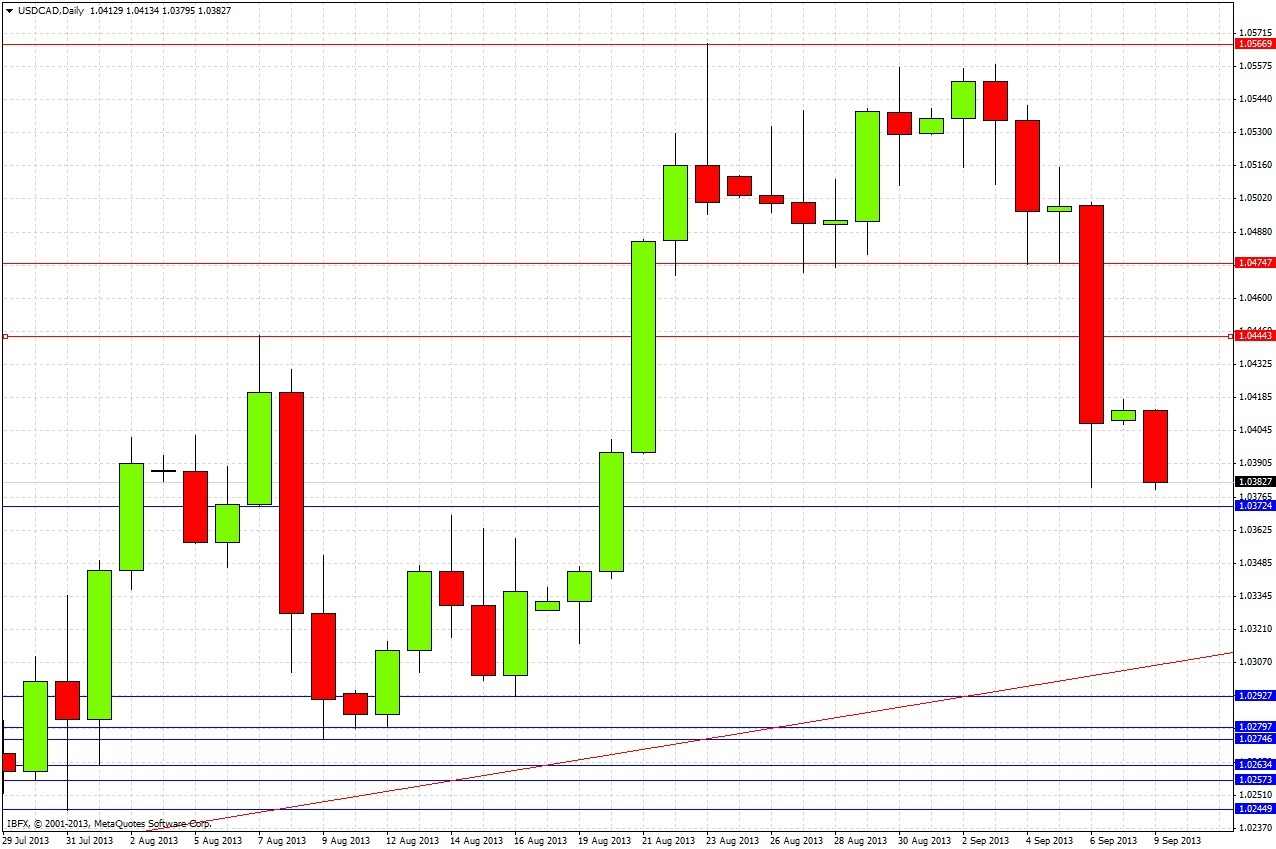

Finally, let's go back to the daily chart:

Things certainly look bearish. Friday was a bearish reversal, and the price over the past few days has decisively broken support at 1.0475 that held up over several days, and the longer-term support at 1.0444.

The best bets in the near future look like:

1. A counter-trend long trade somewhere between 1.0372 and 1.0300: this round number should be roughly confluent with the bullish trend line for a few more days. This zone is likely to provide some support, even if only a modest bounce.

2. Alternatively, should the price rise to retest 1.0444, this previous support might turn into resistance and be a great trade to ride a resumption of the downwards move. Above that, there is also the 1.0475 level which could act in the same way.

3. Should price reach the zone between 1.0250 and 1.0275, this area is likely to act as very strong support, so there should be some long opportunity there.

That said, sentiment is going to be a major factor influencing this pair over the coming days. The closer we get to military conflict in the Middle East, the further this pair is going to drop, and SR levels are not necessarily going to be respected very closely. At the moment when any conflict would begin, there will probably be an immediate drop. So if you are going to trade this pair, keep a close eye on the news, and be prepared with your stop loss: don't be surprised if even a wide, emergency stop loss is suddenly hit.