GBP/USD Signal Update

Yesterday’s signals expired without being triggered as the price did not reach either 1.6914 or 1.7032.

Today’s GBP/USD Signals

Risk 0.75%.

Entries must be made before 5pm London time today.

Short Trade 1

Go short after bearish price action on the H1 time frame following the first touch of 1.7032.

Put a stop loss one pip above the swing high.

Move the stop loss to break even when the price reaches 1.6990.

Remove 50% of the position as profit at 1.6990 and leave the remainder of the position to ride.

Long Trade 1

Go long after bullish price action on the H1 time frame following the first touch of 1.6914.

Put a stop loss one pip below the swing low.

Move the stop loss to break even when the price reaches 1.6975.

Remove 75% of the position as profit at 1.6975 and leave the remainder of the position to run.

Long Trade 2

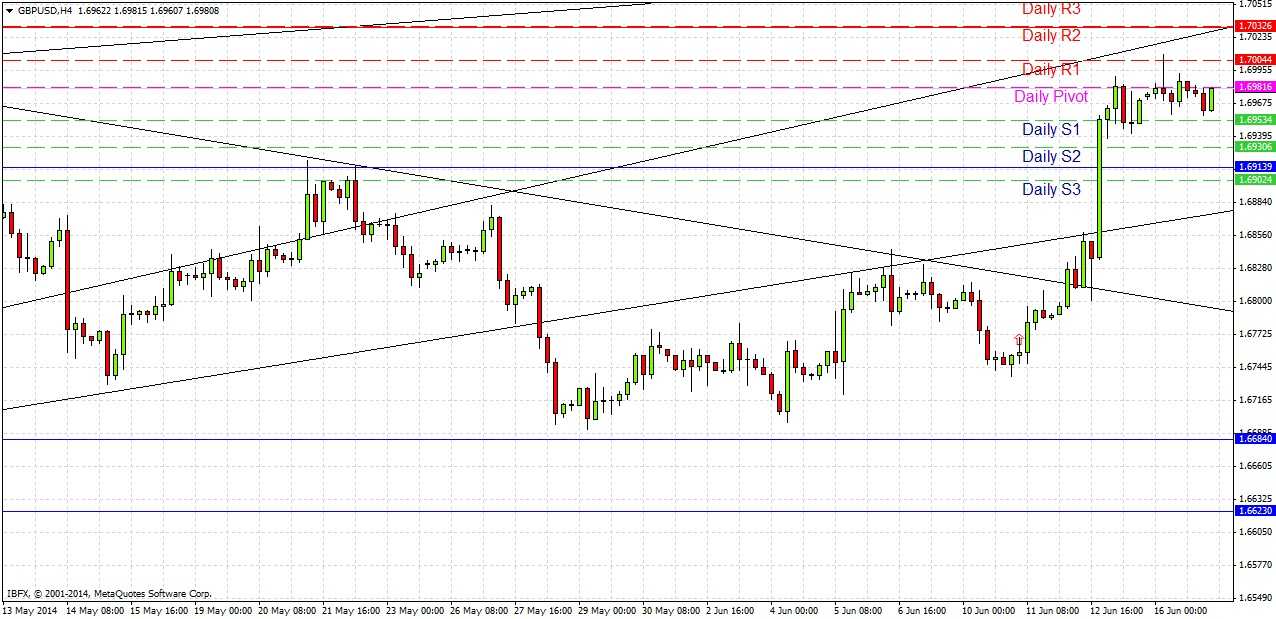

Go long after bullish price action on the H1 time frame at the first bullish trend line below, currently sitting at around 1.6880.

Put a stop loss one pip below the swing low.

Move the stop loss to break even when the price reaches 1.6975.

Remove 75% of the position as profit at 1.6975 and leave the remainder of the position to run.

GBP/USD Analysis

The GBP remains the strongest of all the major currencies over the past year. Although it recently broke down below a significant, long-term bullish trend line, it shot up at the end of last week as a greater prospect of an increase in the U.K.’s base rate was indicated by the Bank of England, and the price yesterday made a new multi-year high.

The previous resistance at 1.6914 can now be expected to act as resistance, as can the old long-term bullish trend line below that albeit with less certainty.

Above the current price there is a good flipped resistance level that is right now very confluent with another old bullish trend line that might become powerful again, so it is possible to look for a conservative short up there at around 1.7032.

There is a release of the U.K. CPI data at 9:30am London time, which may affect the GBP. Later at 1:30pm there will be a release of U.S. data: Building Permits and Core CPI, which might affect the USD. Today is likely to be a fairly active day for this pair.