GBP/USD Signal Update

Yesterday’s signals were not triggered and expired.

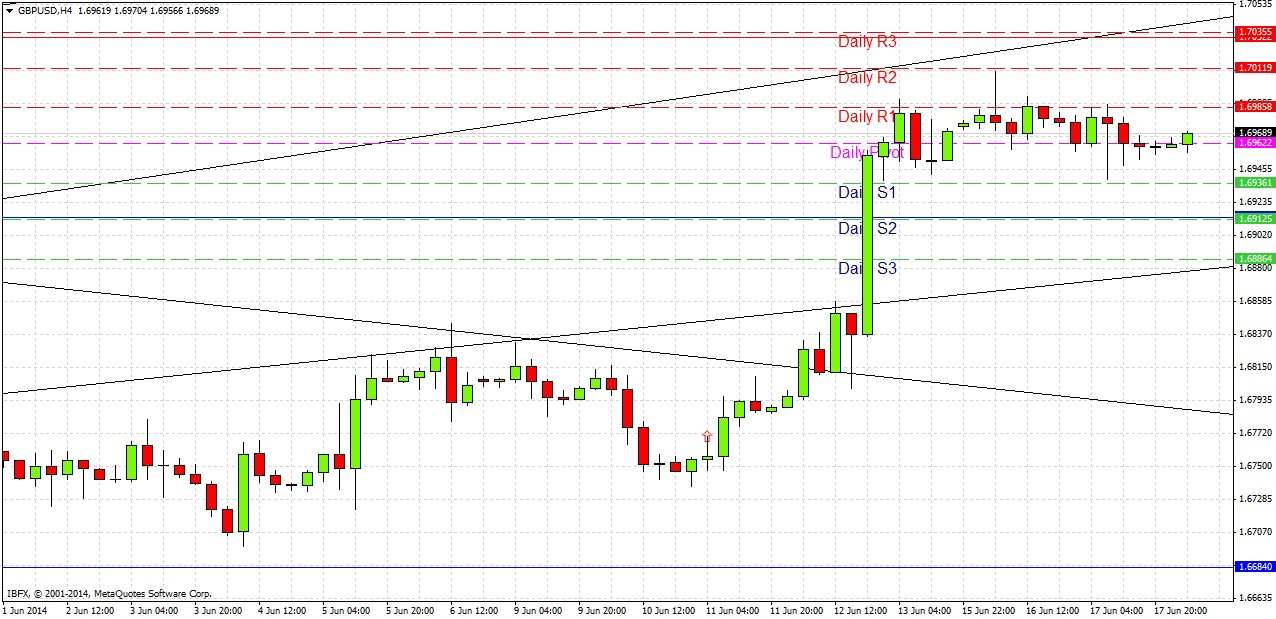

Today’s GBP/USD Signals

Risk 0.75%.

Entries may be made only between 9am and 2pm London time today.

Short Trade 1

Short entry after bearish price action on the H1 time frame following the first touch of 1.7032.

Place the stop loss one pip above the swing high.

Adjust the stop loss to break even when the price reaches 1.6990.

Take off 50% of the position as profit at 1.6990 and leave the remainder of the position to run.

Long Trade 1

Long entry after bullish price action on the H1 time frame following the first touch of 1.6914.

Place the stop loss one pip below the swing low.

Adjust the stop loss to break even when the price reaches 1.6960.

Take off 75% of the position as profit at 1.6960 and leave the remainder of the position to run.

Long Trade 2

Long entry after bullish price action on the H1 time frame at the first bullish trend line below, currently sitting at around 1.6880.

Place the stop loss one pip below the swing low.

Adjust the stop loss to break even when the price reaches 1.6960.

Take off 75% of the position as profit at 1.6960 and leave the remainder of the position to run.

GBP/USD Analysis

Very little happened yesterday which is not surprising as there is major news due today for both the GBP and USD sides of this pair. The price is currently ranging around the GMT daily pivot. Little should happen until we approach the major news due this morning at 9:30am London time.

The previous resistance at 1.6914 may now act as support, as might the old long-term bullish trend line below that albeit with less certainty.

Above the current price there is a good flipped resistance level that could give a conservative short opportunity at around 1.7032.

The big news due today is the US FOMC Statement, Projections and Press Conference at 7pm London time. This pair is likely to be very quiet until shortly before that time, when volatility will probably increase. There is also U.K. news due today at 9:30am when the Bank of England will announce the Base Rate and Asset Purchase Facility votes. Then at 12:15pm and 6:30pm there will be MPC Members speaking publically. Therefore it is likely to be a very active day for this pair, as one of the few currency pairs worth trading today before the FOMC activity after the London close.