GBP/USD Signal Update

Yesterday’s signals expired without being triggered as the price never hit either 1.7032 or 1.6914.

Today’s GBP/USD Signals

Risk 0.75%.

Entries must be made before 5pm London time today.

Short Trade 1

Go short after bearish price action on the H1 time frame following the first touch of 1.7032.

Put a stop loss one pip above the swing high.

Move the stop loss to break even when the price reaches 1.6990.

Remove 50% of the position as profit at 1.6990 and leave the remainder of the position to ride.

Long Trade 1

Go long after bullish price action on the H1 time frame following the first touch of 1.6914.

Put a stop loss one pip below the swing low.

Move the stop loss to break even when the price reaches 1.6960.

Remove 75% of the position as profit at 1.6960 and leave the remainder of the position to ride.

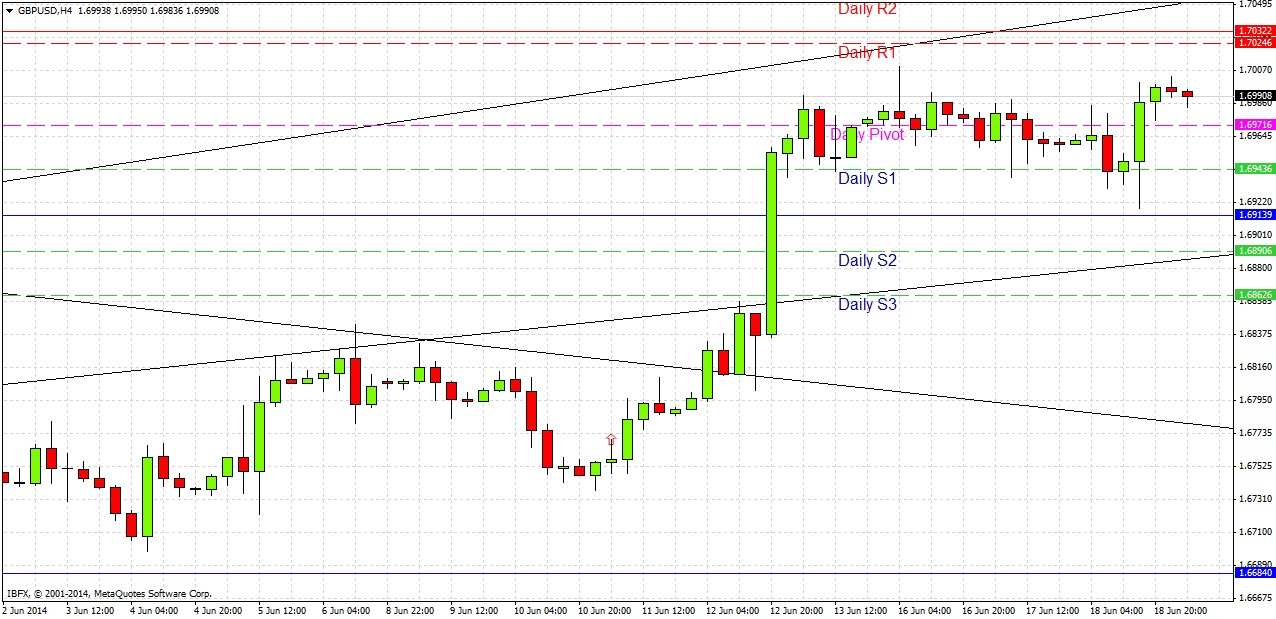

GBP/USD Analysis

Very little happened yesterday before the FOMC announcements. Afterwards, the price moved down to within a few pips of the forecast support level at 1.6914 before moving upwards quite sharply. Despite that, all of the key support and resistance levels are intact and look like they can still be useful.

We are not very far away from both 1.6914 and 1.7032 so I will look for price action to long and short at them respectively.

The old, re-established bullish trend line is now approaching close to 1.6914 which should strengthen the support there. A bullish candle rejecting both the horizontal level and the trend line would be a strong long opportunity.

There will be a release of UK Retail Sales data at 9:30am London time, which may affect the GBP. Later at 1:30pm US Unemployment Claims numbers will be released, followed by the Philly Fed Manufacturing Index at 3pm. This pair will probably be at least fairly active today.