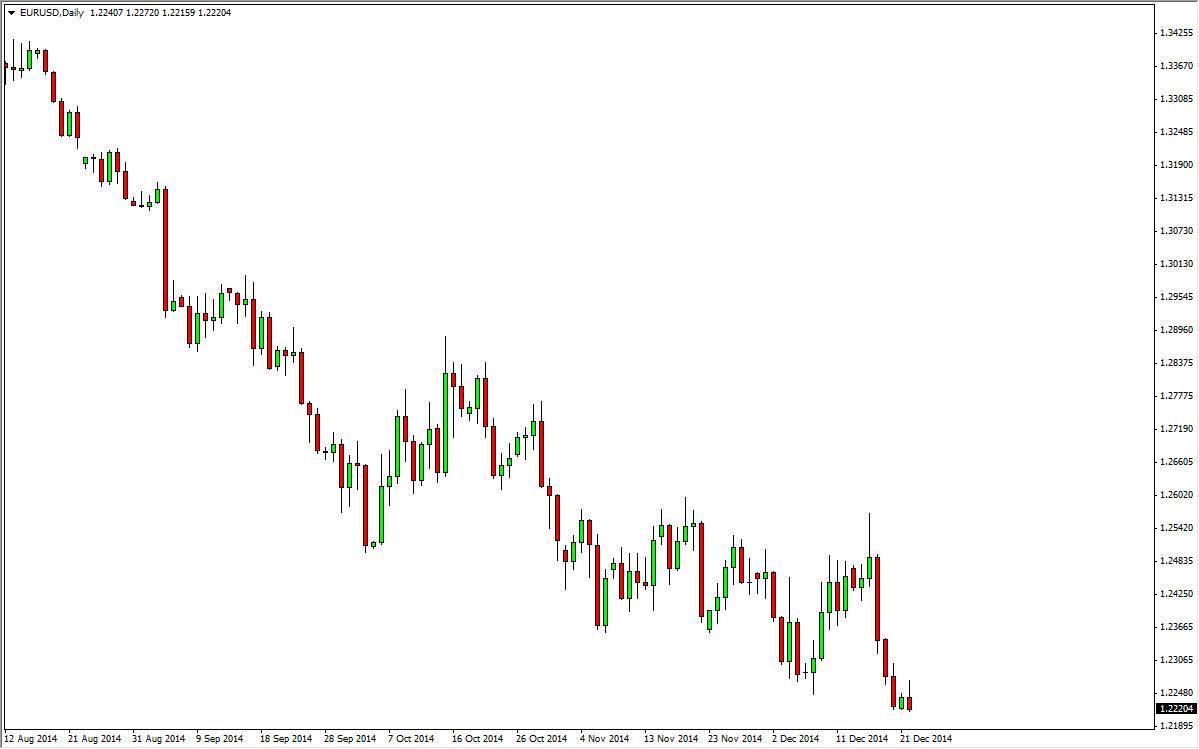

The US dollar continues to strengthen against most currencies, and of course the Euro isn’t going to be any different. Truthfully, this is probably one of the most obvious signs of you us dollar strength, as the Euro has absolutely crumbled over the last several months. True, the rate of descent has slowed significantly, but at the end of the day I feel that every time this market rallies it is a selling opportunity. That is how I’m trading this market overall, and you have to think about this market in terms of value when it comes to the US dollar. Every time this market rallies, it essentially makes the US dollar “cheap.”

Looking at the shape of the candle for the session on Monday, the shooting star of course suggests that we are going to continue to see weakness. Ultimately, I still believe that this market goes down to the 1.2050 level, which was the beginning of the uptrend that we have now shattered.

Markets look soft, and should continue to be.

I think that in general the US dollar will continue to be the strongest currency in the Forex market for the next couple of months at least. I believe that this market will continue to look soft over the longer term, and I also believe that there is a massive “ceiling” in this marketplace at the 1.25 handle, which extends all the way to the 1.26 level.

Rallies should continue to see sellers step been to punish them, and every time this pair rises, I am looking to shorter-term charts for selling opportunities. That being the case though, I also recognize that this is Christmas week, so it’s possible that the moves will be fairly erratic. I’m not looking for large moves this week, and possibly next week either. However, I do think that the overall trend should continue as we go forward. I have no interest in going against this trend, and as a result am essentially in the “sell only” camp.