Gold prices fell 1.5% yesterday, extending their losses to a second straight session, as the dollar rally eroded the appeal of the precious metal. The precious metal also faced pressure due to subdued inflation outlook and heightened appetite for more conventional assets (such as stocks). Both the Dow Jones and S&P 500 advanced to records on Monday and it seems that the risk-on attitude will continue to have a great influence on gold prices for some more time.

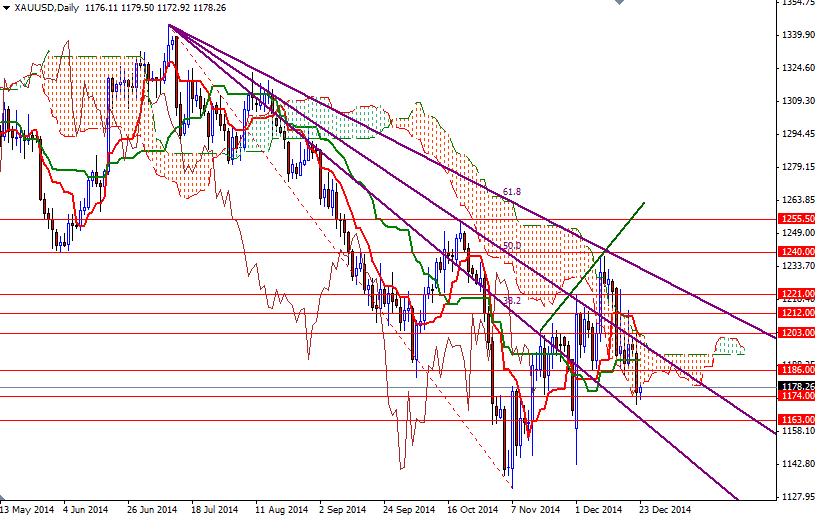

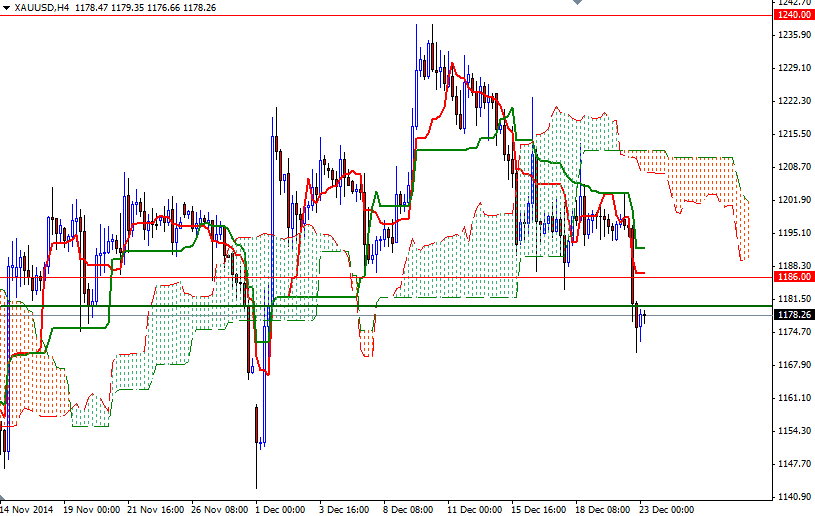

The XAU/USD pair is trading at $1178.26 on the second trading day of a holiday-shortened week and I will be focusing on the 4-hour chart mostly. Breaking below the 1186 support level dragged the market back to the 1174 level where the bottom of the Ichimoku cloud on the daily chart resided and I think remaining beneath this level will some extra advantage to the bears - especially while we have a negative picture on the 4-hour time frame. Prices are currently below the Ichimoku clouds and yesterday's price action pushed the Chikou-span (closing price plotted 26 periods behind, brown line) below the cloud as well.

If the bulls fails to defend the 1174/0, then I think the XAU/USD pair will visit the support at 1163 afterwards. Once below 1163, the bears will be aiming for 1155 and 1150. However, If prices climb and hold above the 1186 level, the bulls may have another chance returning the 1193 level. Beyond that, the real challenge will be waiting the bulls at the 1203 level where the top of the daily cloud and Tenkan-sen line (nine-period moving average, red line) coincide.