The XAU/USD pair posted first weekly loss in three weeks and settled at $1195.71 per ounce. A stronger dollar and the rebound in equity markets worldwide drew some investors away from gold. The Federal Reserve on Wednesday offered a strong signal that it was on track to raise interest rates. On the other hand, Fed Chair Janet Yellen emphasized that the Federal Open Market Committee was unlikely to hike rates for at least a couple of meetings.

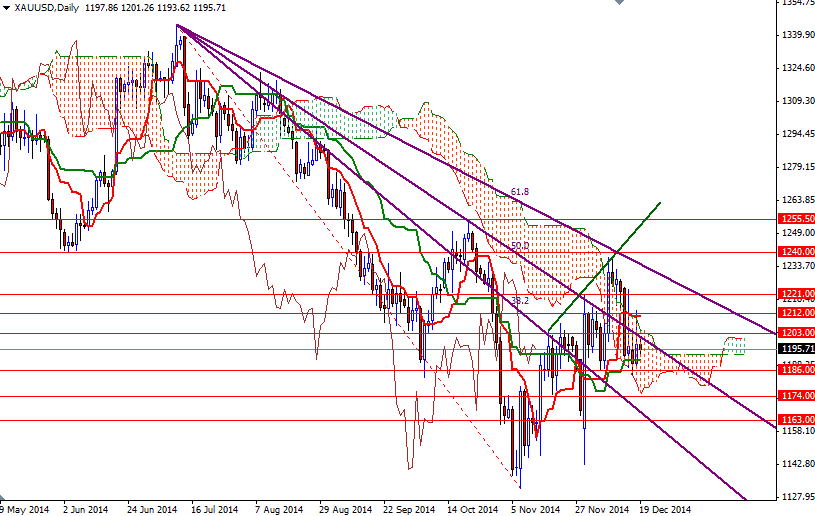

The XAU/USD pair tried to climb above the 1212 resistance level on Thursday but her comments which encouraged a perception in the market that the first increase in near zero short-term rates won't start until the middle of the next year were not enough for the bulls to overtake the bears. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 118480 contracts, from 114862 a week earlier.

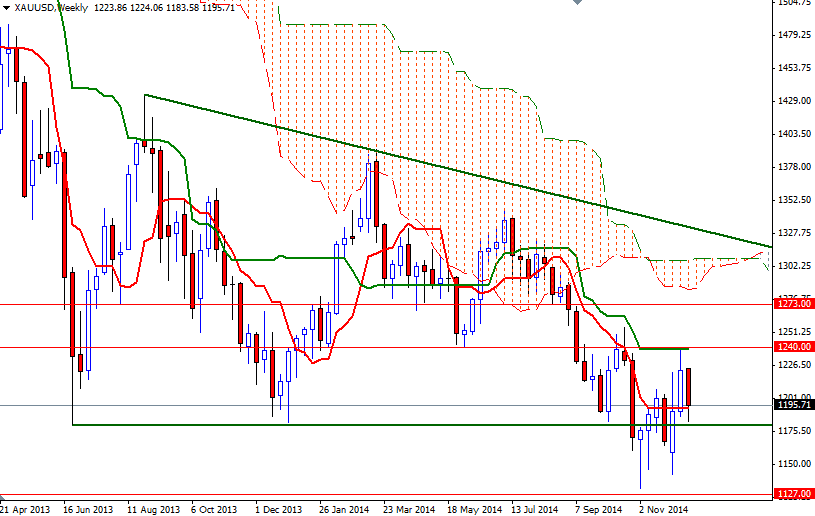

Technically speaking, the precious metal will remain in a downtrend as long as prices don't anchor somewhere above the Ichimoku cloud on the weekly chart. Of course, in order to reach that point (i.e. to confirm a rebound towards that barrier) the bulls will definitely have to push prices above the 1221 - 1240 area. To the down side, I will be keeping an eye on the 1186 support level. If the bulls fail to defend this level, then their camp at 1174 will be at risk. Closing below 1174 on a daily basis would suggest that there is a strong possibility that prices will fall to the 1163 level before finding some support.