EUR/USD Signal Update

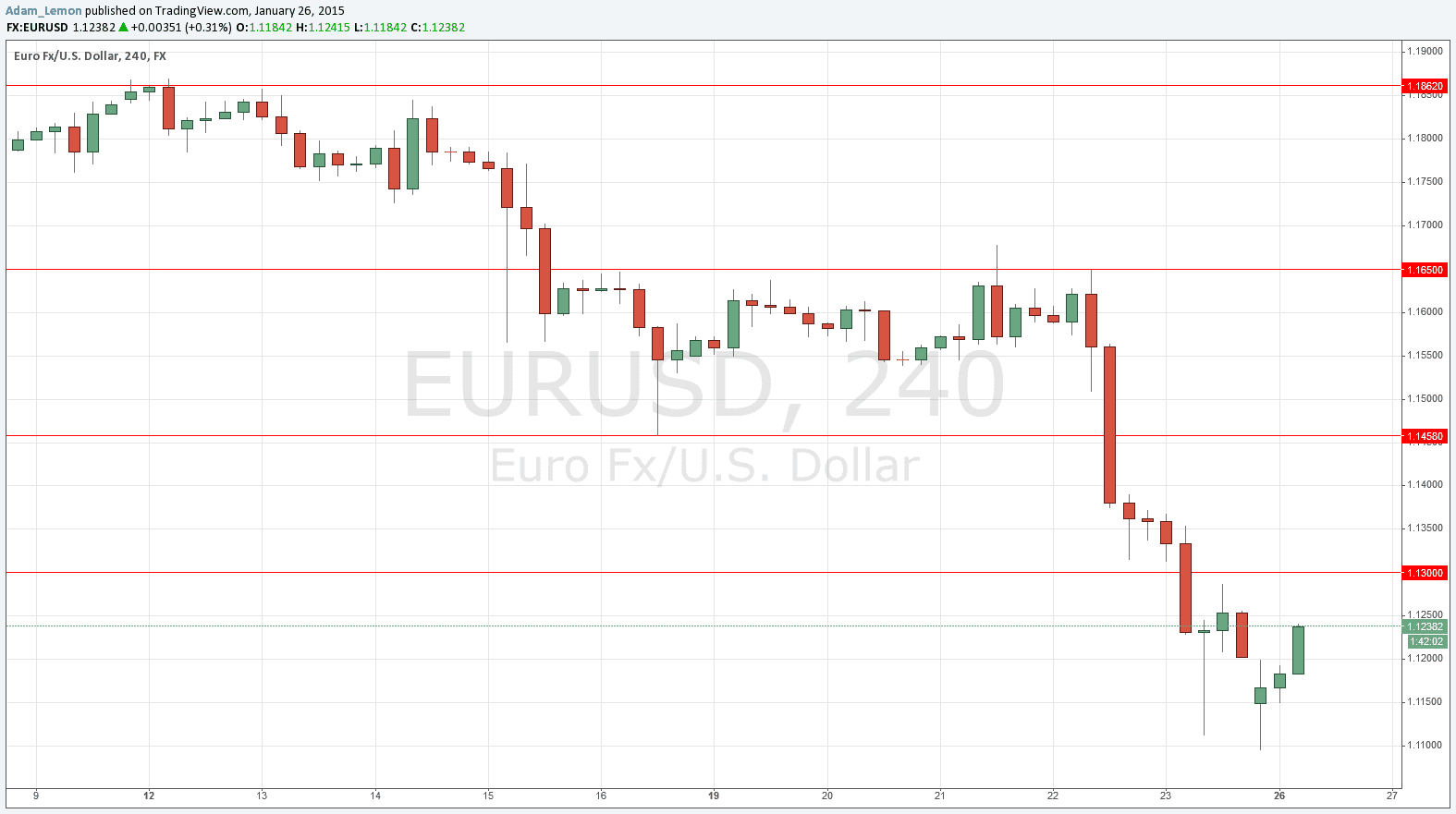

There are no outstanding signals. Any traders short from the 1.1650 area or above would do well to be taking in at least some profit, if they have not done so already.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be entered before 5pm New York time only.

Short Trade 1

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.1300.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

Short Trade 2

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.1458.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

I wrote in last Thursday’s analysis that if the ECB were to announce a QE program beyond what the market was expecting, this pair would be likely to resume its downtrend. This is exactly what happened, with the pair falling strongly Thursday night and Friday morning, before pulling back fairly sharply. Yesterday’s Greek election result drove the price down just below 1.1100, which was another 11 year high, although it has recovered by more than 100 pips. These are quite strong moves, but the pair will probably settle now.

As the moves were so wide, it is a little hard to predict exact likely turning points, but the nearest resistance could be expected roughly confluent with the whole round number above us at 1.1300.

There are no high-impact data releases scheduled today concerning the USD, but at 9am London time there will be a release of German IFO Business Climate data, which may affect the EUR.