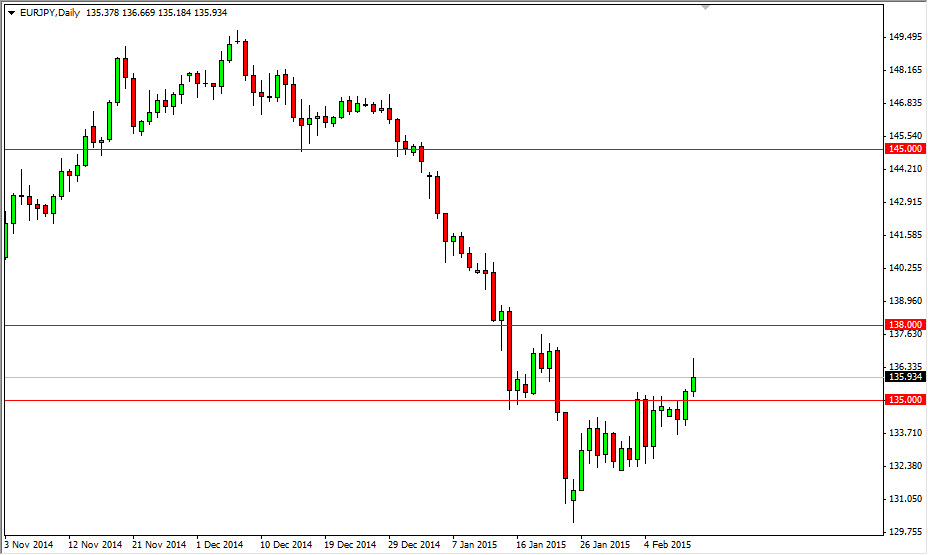

The EUR/JPY pair tried to rally during the course of the session on Wednesday, but as you can see gave up quite a bit of the gains. By doing so, it formed a shooting star, signaling that perhaps the resistance zone that I had pointed out previously is in fact going to hold. I suggested that there could be resistance between the 135 and 138 levels, and it does in fact look like that’s the case. With that being the case, I believe that the Euro is going to continue selling off, and with that I would be short of this market if we can break down significantly below the 135 handle.

Perhaps somewhere below the 134.50 level, I feel that the bottom will fallout in this market should head back down towards the 130 level. Quite frankly, I don’t like the Euro in general, and at this market is in a downtrend for a reason. I think that there are more surprises and concerns coming out of Europe, especially with uncertainty around the Greek debt problem. (Can you say déjà vu?)

Following the longer trend

By selling this market, you are simply following the longer-term trend anyways, as it is most certainly negative at this point in time. Although I don’t necessarily like the Japanese yen in general, trading it against the Euro is a completely different scenario at this point in time, as the market will be a little bit of an outlier as far as yen related pairs are concerned.

I have no scenario in which I want to buy this pair below the 138 handle. If we did break above there, I think that would change the attitude of the market completely, probably sending this market looking for the 145 handle given enough time. However, that will most certainly be something against the yen, and nothing to do with the Euro itself. That’s not to say can happen, just that I find it extremely difficult to believe at this point in truthfully if I wanted to sell the Japanese yen, I would probably do it against the different currency anyway.