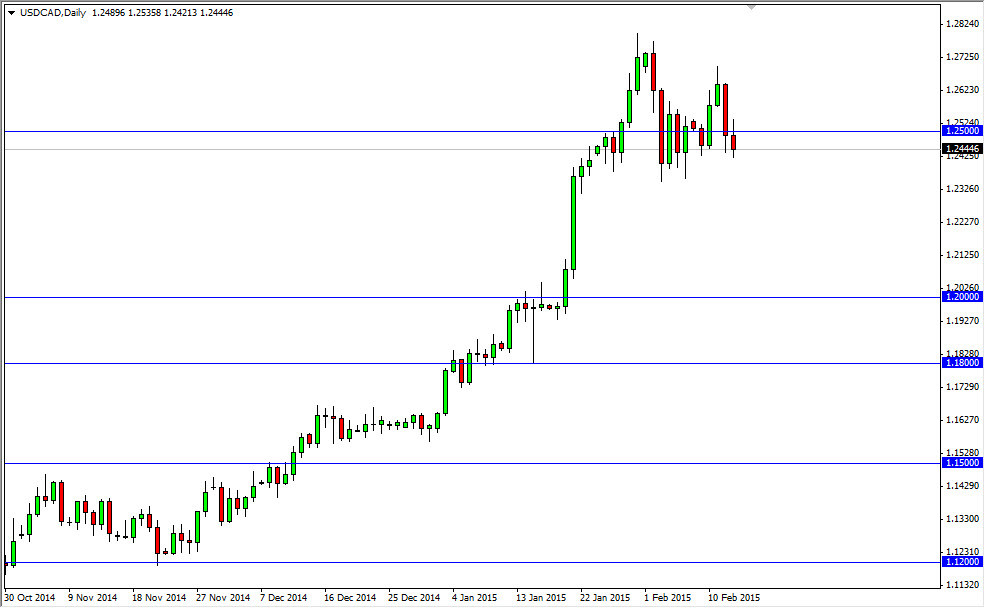

The USD/CAD pair initially tried to rally during the course of the day on Friday, but fell back down and close below the 1.25 handle. I believe that there is a significant amount of support all the way down to the 1.24 handle anyway, but when I look at the longer-term charts I cannot help but notice that the weekly candle is a shooting star, and that we are overbought. There’s really no two ways around it at this point in time, and it also looks like we could possibly be looking at a bullish move in the oil market coming soon, so that makes sense to me that this pair would fall from here.

This isn’t to say that I am looking short this pair, far from it. I believe that we break down below the 1.24 level and then head to the 1.20 handle. At that point in time I suspect there would be plenty of value to be had in this market, and I would be looking for a supportive candle. That region extends all the way down to the 1.18 handle, so there should be plenty of buyers down there.

Watch the oil markets

I believe that the oil markets are going to lead the way in this particular move. If they start writing, this pair will fall and I will watch for resistance in the oil markets to turn around and start buying this pair. If all works out, we could get a nice signal from that market that coincides with a move down to the 1.20 handle. Even if we don’t get that move all the way down there, I think that a supportive candle between here and there is reason enough to start buying as well. There is a potential trend line that we are approaching, which would be a little bit above the 1.20 level at this point in time, but I’d be willing to take that trade as well, as this pair is most certainly bullish.