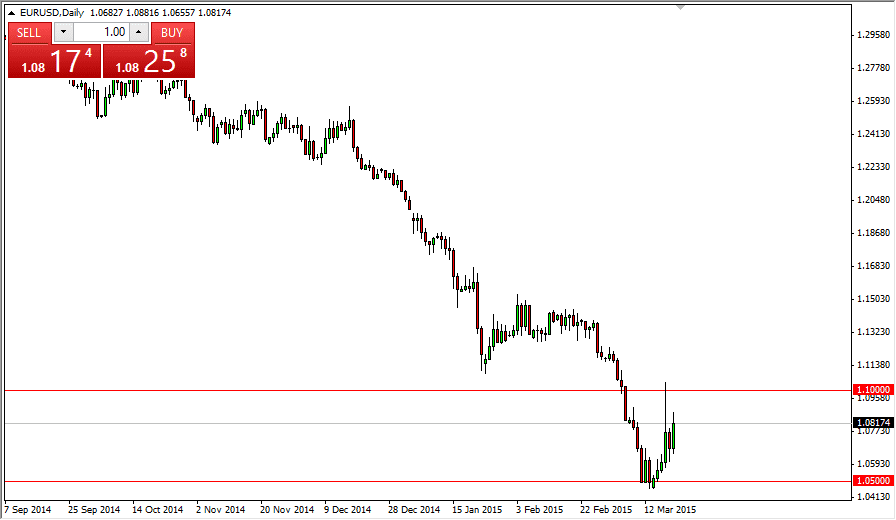

The EUR/USD pair rallied during session on Friday, but as you can see remains well below the 1.10 level. It now looks as if we are ready to continue to grind between the 1.05 level on the bottom, and the 1.10 level on the top. Because of this, I think that you may have to switch to the shorter time frames, but ultimately I still believe that this pair breaks down. I think that the 1.10 level will offer a bit of a “ceiling” in this market, but it’s probably going to be far too strong to break out of. In other words, I believe that this is going to be the type of market that you can sell and so again, but probably for short-term trades at best. This pair is obviously very bearish, and as a result it’s going to be difficult to imagine that the bullish traders will be able to hang onto any significant amount of a move.

I believe that the market should then continue to follow the lead of the European Central Bank, as it increases liquidity in the European Union. Bond yields will continue to bring absolutely nothing in the way of returns, and therefore money will be flying out of Europe and into other bond markets around the world, most especially the United States as the interest rates are rising slightly.

[CAD:FXAcademy CTA #73]Federal Reserve

It still appears that the Federal Reserve is on track to raise rates sometime over the course of the next year, and as a result people will continue to favor the US dollar in the near term. I believe that this market is ready to head down to the parity level next, but we have to get below that 1.05 level. So this is essentially going to be a bit of a “two speed” marketplace, with the near-term marketplace offering small moves, but once we break below the 1.05 level I believe it becomes more of a “sell and hold” type of situation until we get down to the parity level where I would anticipate a massive amount of support.