Gold prices initially moved higher on Monday as physical demand in Asia provided some support but reversed course before midday. Renewed worries over Greece's debt problems triggered safe-haven bids for the precious metal but the market continued to feel the repercussions of the last week's move. Friday's employment figures we higher than most people expected and that put the risk of a mid-year Fed hike on the table.

Also the uptrend in equities made gold less attractive as an alternative asset. Resilient stock markets mean gold prices may struggle to push significantly higher over the medium term. However, prices are getting close to production costs and central banks will probably start buying if we approach the 1000 - 980 region.

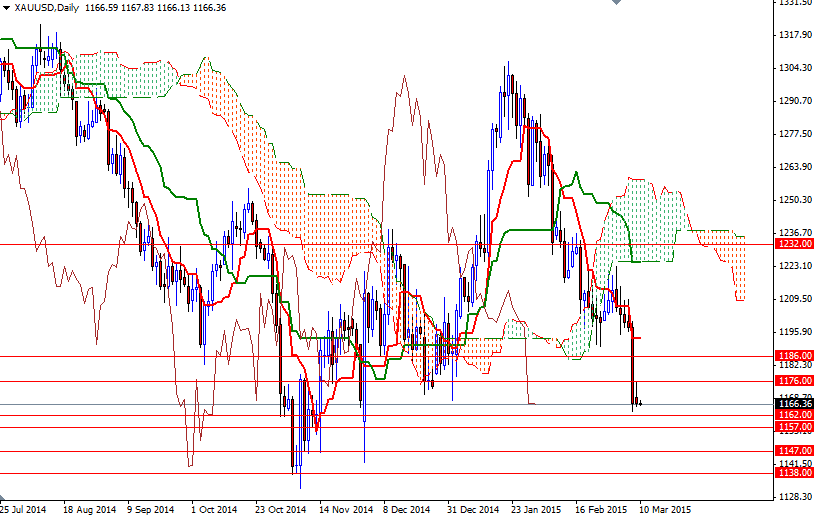

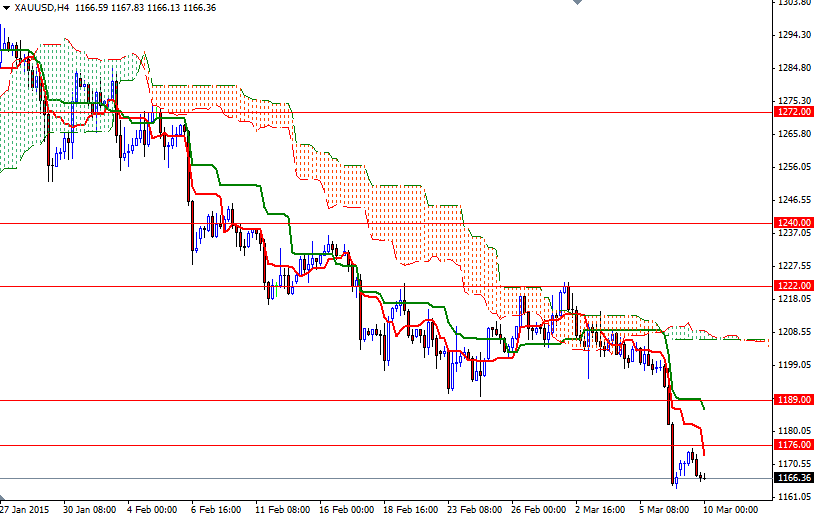

From a technical perspective, I expect the market to maintain its negative bias unless we make it back above 1189/6. The XAU/USD pair is trading below the Ichimoku clouds on the weekly, daily and 4-hour time frames and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-day moving average, green line) lines are negatively aligned. In addition, the daily Chikou-span (closing price plotted 26 periods behind, brown line) is indicative of solid downward momentum. Because of that, I think the market will have a tendency to test the 1162 - 1157 area. If the XAU/USD pair breaks down below the 1157 level, it is likely that the market will test 1147 next. To the upside, expect to see resistance at 1176 and 1189/6. The bulls have to capture this first strategic fort in the 1189/6 zone so that they can gain enough traction to head towards the 1200 - 1199 resistance.