Gold prices initially moved lower on Tuesday but cut losses as weaker than expected U.S. retail sales and producer prices data led to a pullback in the dollar. The Commerce Department reported that retail sales advanced 0.9%, below the consensus forecast of a 1.1% rise, after a 0.5% drop in February. Separately, the Labor Department's data showed the producer price index rose only 0.2% last month. The XAU/USD pair, which broke below the 1198 level and retreated to 1183.27 - 1181 area, climbed back above the 1191 level after the data released.

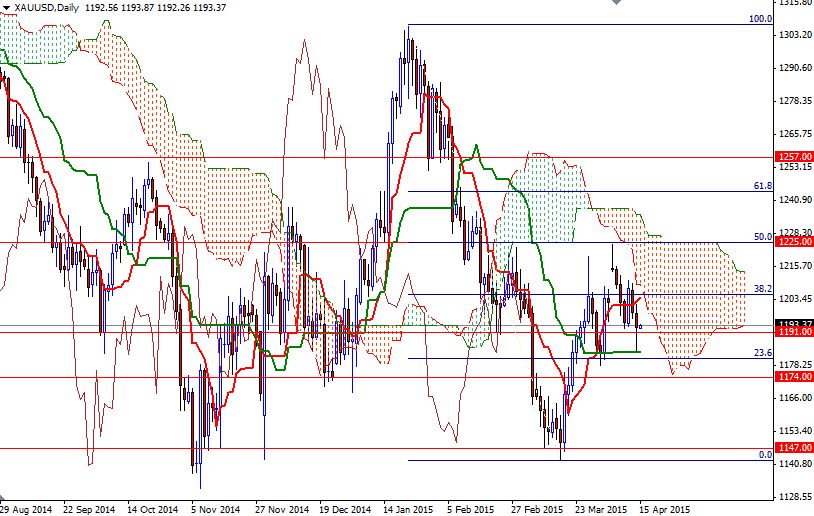

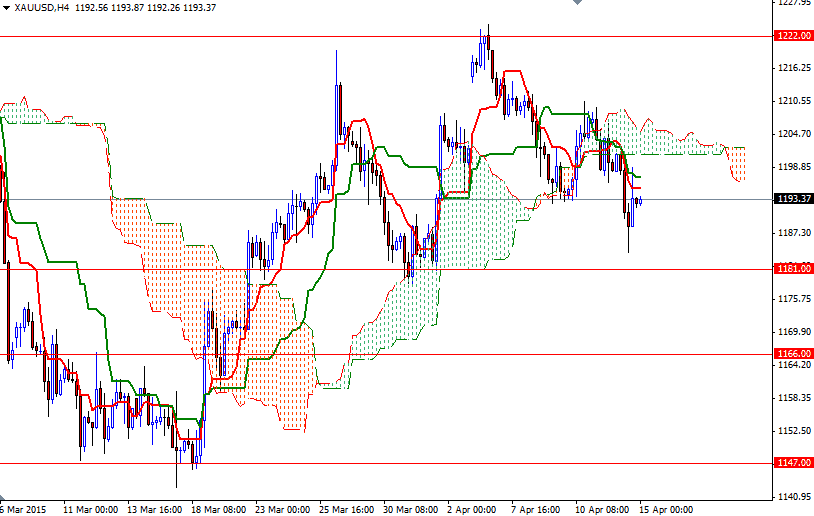

Although XAU/USD bounced off this important support area, where the daily Kijun-sen (twenty six-day moving average, green line) and 23.6 Fibonacci level resided, the short term outlook remains weak. On the 4-hour chart, the market is below the Ichimoku cloud and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-day moving average, green line) lines are negatively aligned. In addition to that, the Chikou-span (closing price plotted 26 periods behind, brown line) dropped through the cloud.

If the intra-day support at 1191 fails to hold the market, then the next stop will probably be the 1188.45 - 1187.20 zone. Once below that, a retest of the 1183.27 - 1181 support seems likely. The bears have to capture this camp so that they can increase pressure and advance towards the 1174 level. If the bulls don't want to give up, they will have to push prices back above the cloud, which occupies the area between 1201.13 and 1205 on the 4-hour time frame. In that case, they could gain enough strength to challenge the bears waiting in the 1214.50 - 1211 region. Breaking above this resistance would probably provide the bulls the extra power they need to test 1225/2.