Gold ended slightly lower on Monday as the dollar recovered some of its recent losses and equity markets saw a modest rebound. In the latest economic data, the Institute for Supply Management's non-manufacturing index came in at 56.5, down from the previous month's 59.9 and below expectations for a reading of 56.6 but Markit said its services purchasing managers' index rose to 59.2, the highest since August.

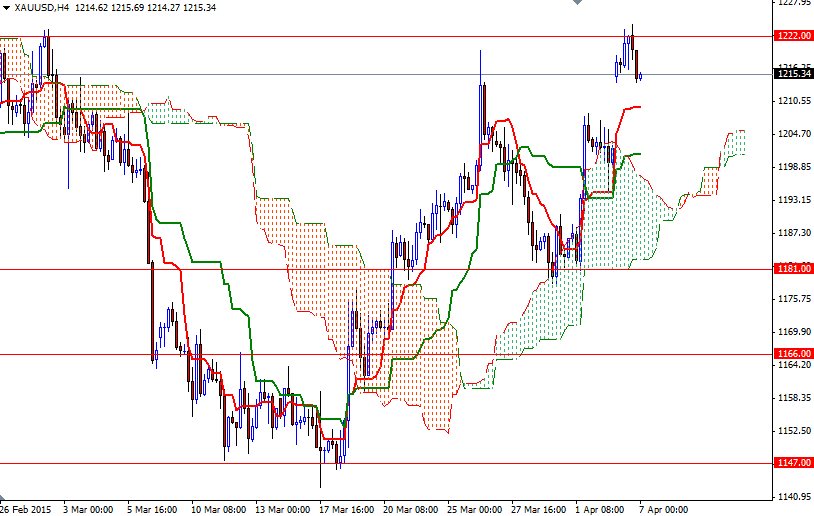

Gold prices initially moved higher and tested the 1225/2 area as expected but found a significant amount of resistance. As a result, the XAU/USD pair pulled back and formed a shooting star. This long wick to the upside suggests that the technical selling pressure will continue to weigh on the market. If that is the case, expect a slide towards the 1212/09 area. The bears will need to shatter this support so that they can test the 1205 level (Fibonacci 38.2). Falling through 1198 would open up the risk of a move back to the 1191 level.

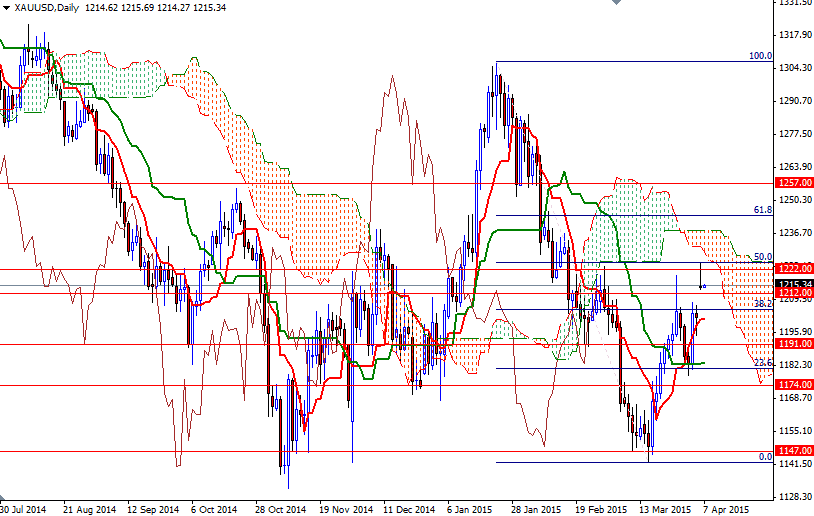

As I said yesterday, XAU/USD has to break above the 1225/2 zone, where the bottom of the daily Ichimoku cloud and the 50% retracement level (based on the distance between 1307.47 and 1142.63) converge, to attract fresh buyers and start a journey towards the 1240/35 region. Technically speaking, the bulls will be having hard time to gain more traction while prices are moving below the daily Ichimoku cloud and similarly the bears will be struggling to regain their strength as long as the market remains above the cloud on the 4-hour time frame.