GBP/USD Signals Update

Yesterday’s signals were not triggered.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be taken between 8am and 5pm London time today only.

Long Trades

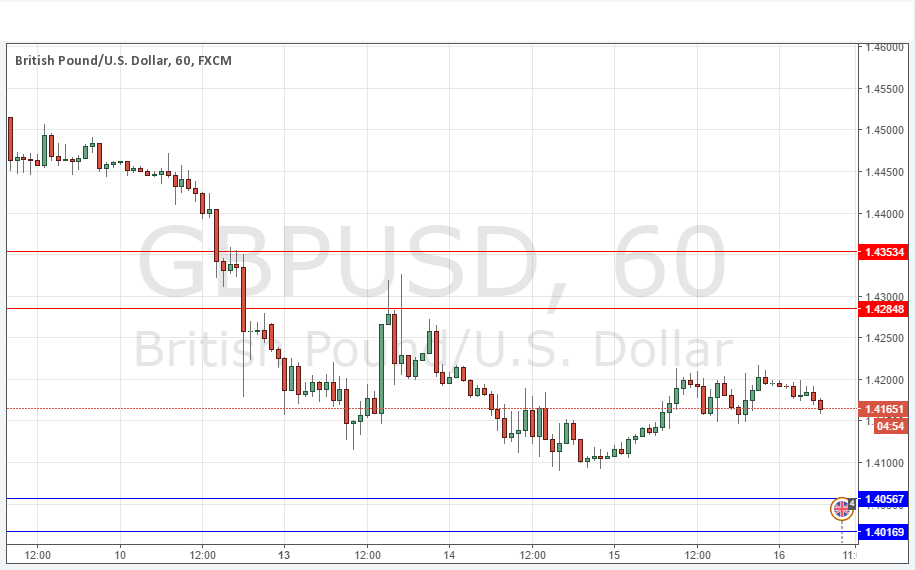

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4057 or 1.4017.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Short Trades

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4285 or 1.4353.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

GBP/USD Analysis

This pair has been even quieter over the past 24 hours, remaining mildly bound by the round numbers on either side which have been containing the price.

Although recent opinion polls suggest Britain will narrowly vote to leave the E.U., no new polls have been released yesterday, and the betting agencies are offering smart money on Britain actually voting to remain, with the probability of Brexit priced in at about 40%.

Trading will continue to be very thin until new polls are released, the results of which could provoke a lot of volatility.

Some economists forecast that a Leave vote will push this pair down to 1.2500.

Concerning the GBP, there will be a release of Retail Sales data at 9:30am London time. Later the Bank of England will release its Monetary Policy Summary, Official Bank Rate and Votes data. Regarding the USD, there will be releases of CPI, Unemployment Claims and Philly Fed Manufacturing Index data at 1:30pm.