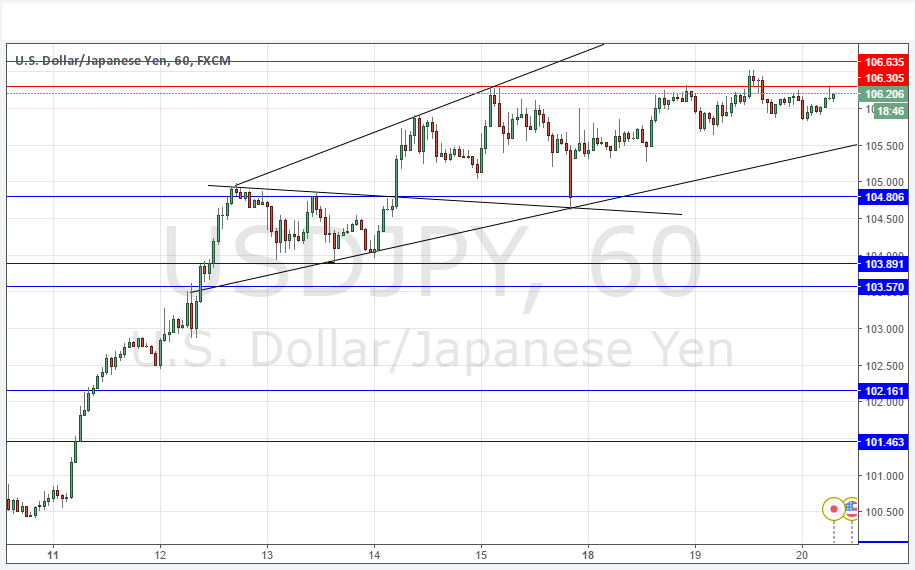

USD/JPY Signal Update

Yesterday’s signals were not triggered as none of the key levels were reached.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be taken only between 8am New York times to 5pm Tokyo time during the next 48 hours.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 106.64.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trades

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 104.80, 103.90 or 103.57.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

I wrote yesterday that another attempt at the resistance level of 106.30 could see a break, “but we have to keep in mind that this band of resistance stretches further still, up to 106.64. Therefore I would not be looking for another short at 106.30 but I would at 106.64. The USD is strong right now but this is a key zone of resistance.”

There has been no change, this area remains resistant although the price has managed to get up to about 106.50. However the force of the upwards move is slowing down. A convincing reversal in this zone near 106.64 could see the start of a downwards move of several hundred pips. Conversely a break up above 106.64 that is sustained would be a very bullish sign, signalling that the long-term downwards trend has probably come to an end.

The price is at a very crucial area

There is nothing due today concerning the JPY. Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time.