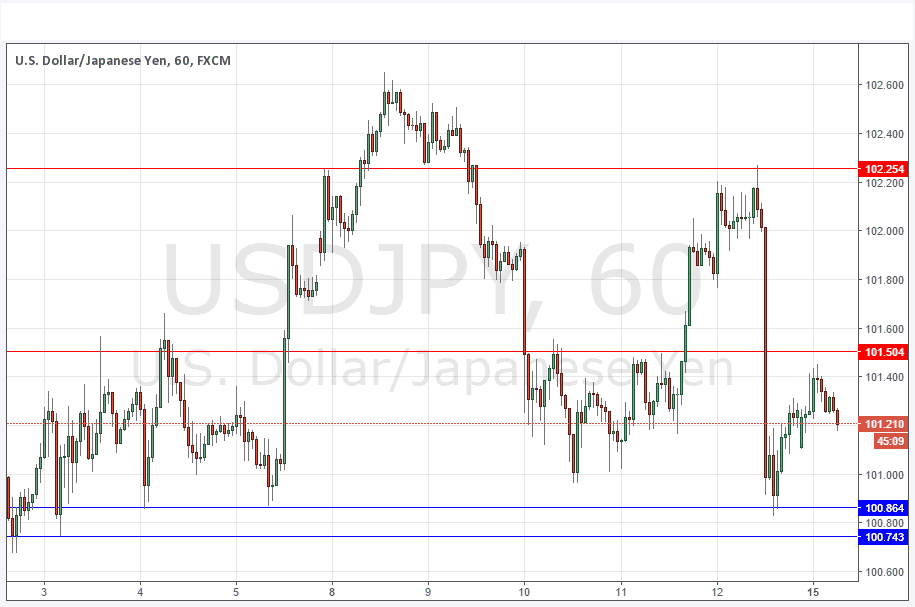

USD/JPY Signal Update

Last Thursday’s signals produced a losing trade following the bearish rejection by a pin candle of the anticipated resistance at 102.00. It gave less than the minimum required 20 pips of profit.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be entered between 8am New York time and 5pm Tokyo time during the next 24 hours only.

Short Trades

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 101.50 or 102.25.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trades

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 100.86 or 100.74.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

The previous day has really just seen this pair chop around, essentially going nowhere. This should not have been a complete surprise, as we have just had a public holiday in Japan. There are two key things to take away from today’s chart: firstly, we seem to keep getting support at 101.00 or maybe a little lower, and if this is maintained, we should eventually see another move up to perhaps 102.50 at least. The second thing is that there is new potential resistance at the round number of 102.00 so it could come into play for sellers if the price makes a new trip up there.

There is a long-term downwards trend, but the first questions are beginning to be asked of it.

There is nothing of high importance due today concerning the JPY. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time.