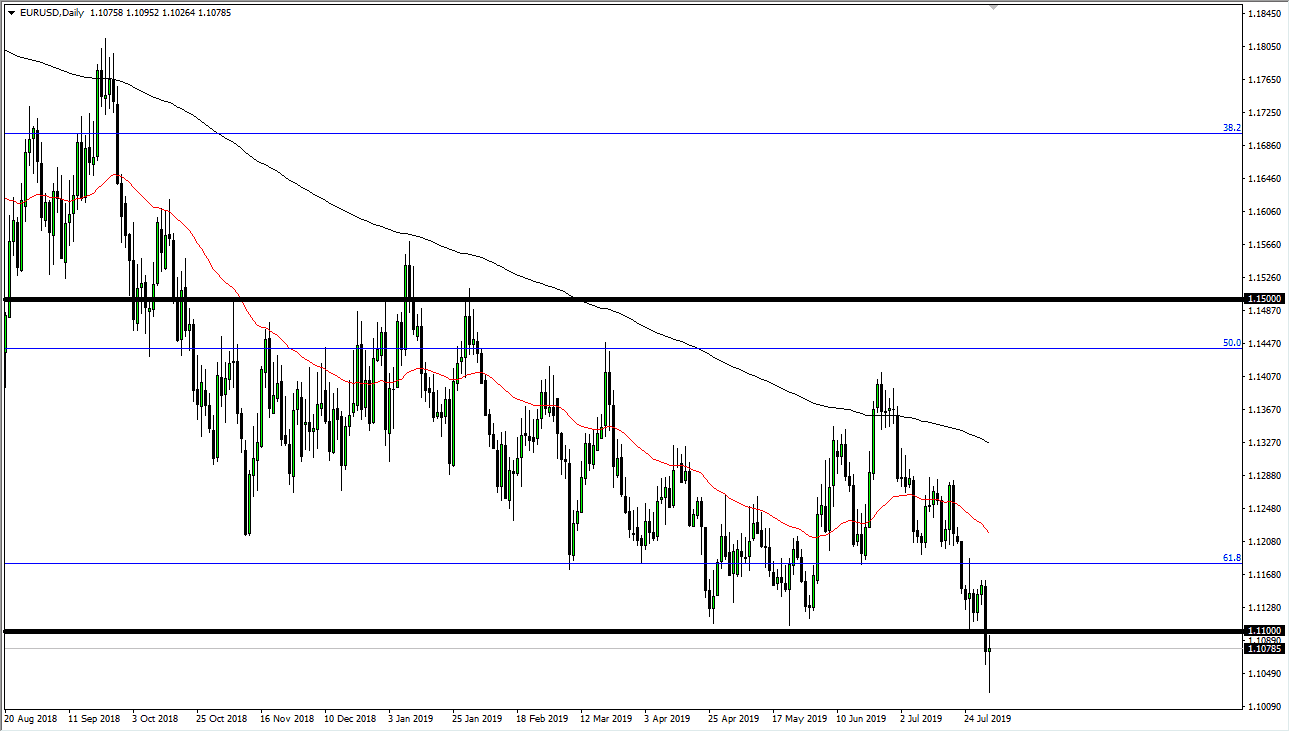

The Euro has fallen pretty hard during the trading session on Thursday, only to turn back around and bounce. The bounce of course has formed a hammer during the trading session on Thursday, heading into the jobs figure. The fact that we are sitting just below the 1.11 the EUR level is not lost on me, and it shows just how choppy and directionless this pair is although, you can also say it’s going lower over the longer-term.

Jobs figures

The jobs numbers come out of the United States during trading on Friday, so that might be part of what we are seeing, a simple return to balance ahead of that crucial number. The markets will be paying a lot of attention to that figure as per usual, especially considering that the Federal Reserve was about as clear as mud during the Wednesday session. Ultimately, traders are starting to question whether or not there more interest rate coming from the Federal Reserve, and the initial run to the US dollar may have been just a bit overdone.

That being said, the jobs figure will be interpreted by a multitude of people during the trading session that will try to decide whether or not it makes another interest rate in the United States more or less likely.

Chinese tariffs

Part of the reason the US dollar may have lost a bit of strength could be due to the President suggesting that there were more Chinese tariffs coming September 1. This had people freaking out to say the least, and people may be reading this as a potential reason for the Federal Reserve to ease monetary policy yet again. That being said, this is a bit of a knee-jerk reaction so I think it’s only a matter time before we get a bit of a turnaround.

Technical analysis

The resistance barrier at the 1.11 level extends all the way to the 1.1150 level, an area that has seen a lot of selling pressure. Ultimately, I think that any exhaustive candle stick between here and there could be a selling opportunity, because of all of the negativity that we have seen lately. When looking at this chart, we are obviously in a very negative trend, so it should not be a huge surprise if we roll over yet again. If we break down below the bottom of the candle stick for the trading session on Thursday, that would be extraordinarily negative. At that point, the market probably runs down to the 1.10 EUR level, an area that will attract a lot of attention due to the round psychological nature of it.

At this point, if we did get a daily close above the 1.12 level, then I would rethink the entire situation but right now it’s obvious that we have been falling and I think it’s with good reason. The European Central Bank is going to continue to struggle to have anything close to a tight monetary policy, and therefore the trend should be followed.