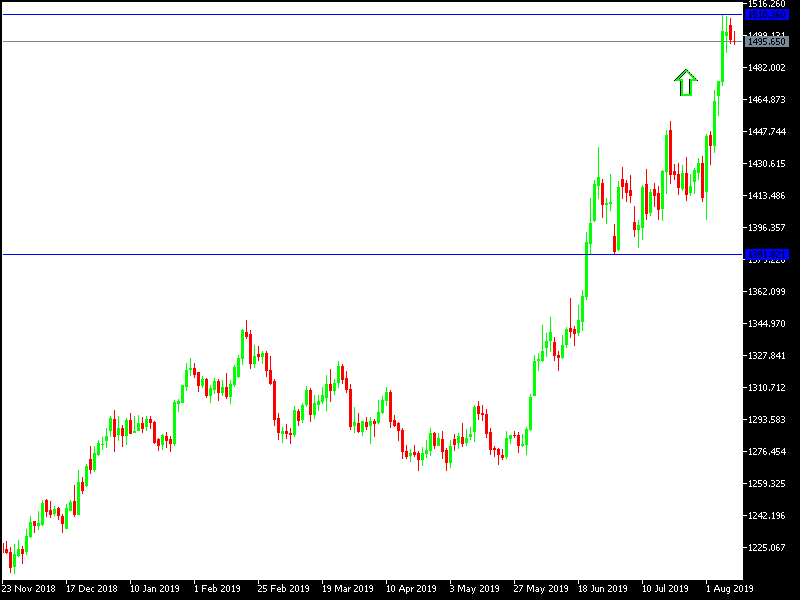

With the beginning of this week’s trading, gold prices are undergoing a downward correction to the 1492 support level, amid profit-taking sellings, after the recent record gains of the yellow metal pushing it to the 1510 resistance level, the highest price for gold in six years. Gold traders are awaiting the price to reach new buying areas, as the strengths of gold continue to increase. Global trade and geopolitical tensions are on the rise and the yellow metal is one of the most important safe havens for investors to hedge against these risks. Investors are following developments in the global trade war, which may naturally slow down global economic growth.

The latest developments include China’s intervention in the exchange market by devaluating the Chinese Yuan against the dollar below the level of 7 dollars in retaliation after the US imposed more tariffs in a long-term trade friction, and there are no signs that the dispute will be resolved soon, with each party sticking to their demands. The prolongation of this war and the expansion of its risks prompted central banks around the world to think seriously and quickly to ease their monetary policy to cope with the consequences of the war, the most prominent decisions of those banks was the Reserve Bank of New Zealand last week to cut interest rates by 50 basis points, more than expected.

The United States has designated China as a currency manipulator and dragged the whole world into a currency war that will weaken the world economy and foreshadow a global economic crisis that could outweigh the 2008 crisis.

Technically: Gold prices today are still ready to return to test stronger resistance areas as the foundations and factors of strength remain, and the continuation of the current correction may push prices towards support areas at 1485, 1472 and 1460 respectively. On the upside, psychological resistance of 1,500 dollars is still a psychological top that supports the strength of the uptrend and the return of stability above that will support the move towards resistance areas at 1515, 1525 and 1540 respectively. Overall I still prefer to buy gold from every bearish level.

In the economic data: Today's economic calendar is completely free of any significant economic data and will interact with the results of the latest economic data and investor confidence.