I mentioned yesterday that the U.S. stock market is still very strong, with the key benchmark S&P 500 Index, composed of the 500 largest U.S. stocks by market capitalization, was only about 10 points off an all-time high.  I’ve also written before about how important all-time highs are in stock markets, as a good statistical indicator that still higher prices are going to happen shortly. Furthermore, there is no stock market in history that has done as well as consistently in terms of prices going up, as the U.S. stock market. These factors add up to a convincing case that it’s beneficial to be long of major U.S. stocks or the major stock index right now.

I’ve also written before about how important all-time highs are in stock markets, as a good statistical indicator that still higher prices are going to happen shortly. Furthermore, there is no stock market in history that has done as well as consistently in terms of prices going up, as the U.S. stock market. These factors add up to a convincing case that it’s beneficial to be long of major U.S. stocks or the major stock index right now.

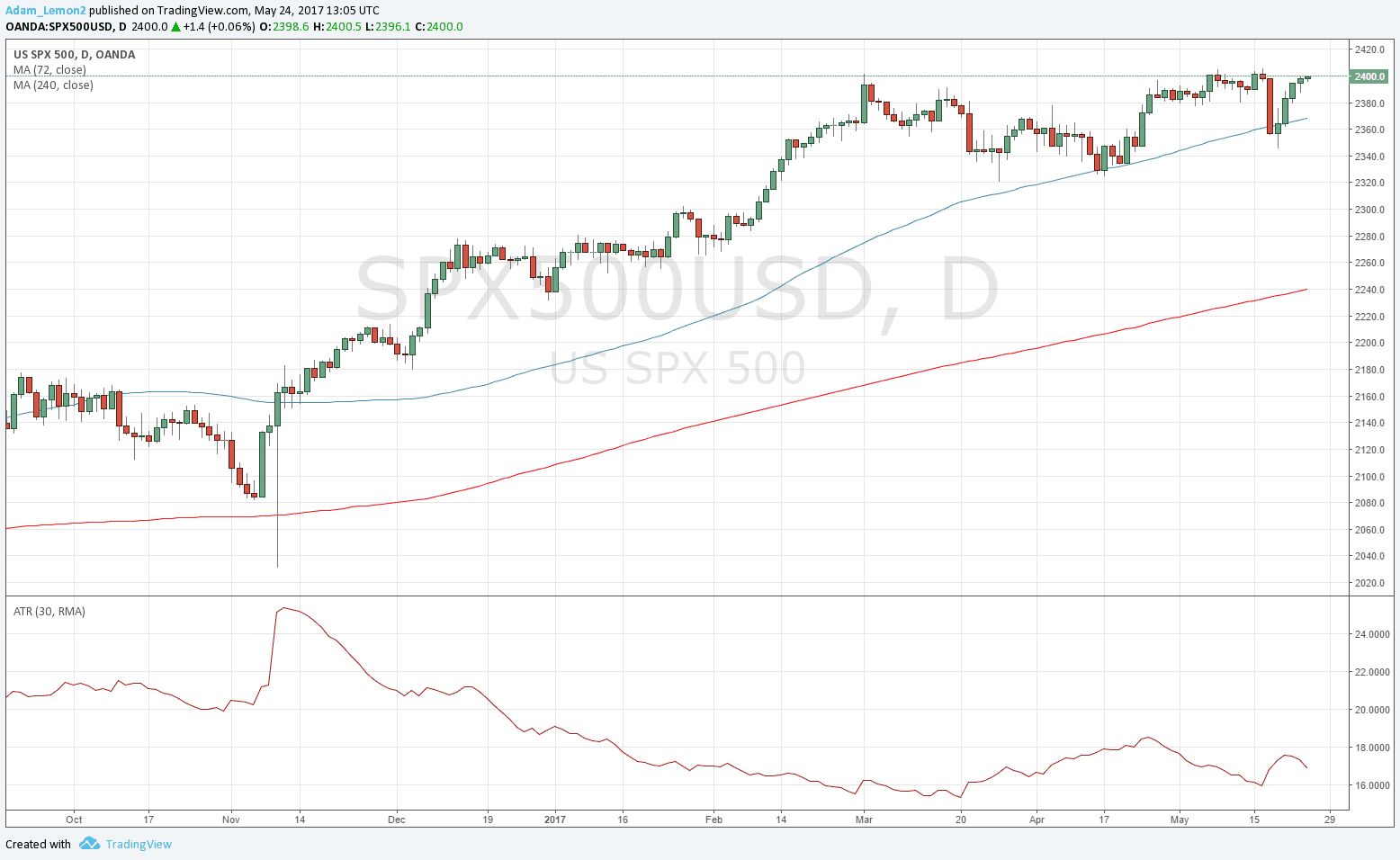

If this is the case, why do we hear such doom and gloom about stocks in the financial media? Well, it is true that volatility is very low. If we look at the daily chart of the S&P 500 Index, and include the Average True Range (ATR) of the past 30 days, we can see that volatility is relatively low, although not excessively so. We can also see that for almost three months now the price has struggled to make meaningful new highs – long-term failure to make new highs on declining volatility is typically the first sign of an impending bear market.

However, another factor to make note of is that you must say that all the key swing lows are intact, and each one gets higher and higher. We have seen a speedy recovery from the last strong dip just a few days ago. It would not be a surprise to see the price make a new all-time high later today after the FOMC Meeting Minutes release, if the contents please the market. There’s nothing wrong with being cautious and taking floating profit off the table, but I think it would be foolish to start going short of stocks just yet – short stocks is a challenging trade anyway.