What is Time Frame in Forex Trading?

“Time frame” in Forex trading means the unit of time that the price chart you are viewing is based on. For example, in a weekly time frame Japanese candlestick chart, each candlestick represents one week of time. In a 5-minute time frame Japanese candlestick chart, each candlestick represents 5 minutes of time. Shorter time frames show much more detail of price movement over time, but longer time frames show wider, longer-term pictures of trends and ranges in the price.

Top Forex Brokers

Why You Should Use the Weekly Time Frame in Forex Trading

The most effective, profitable, and powerful tool you can use to trade Forex is to pay attention to whether or not there is a long-term trend or range in any currency pairs or crosses, especially the major pairs; and if so, in which direction that trend is going. Then, make sure that you trade in the same direction as that trend, or trade reversals from support and resistance when there is no trend and the price is ranging. Use a higher time frame price chart such as the weekly time frame to make these calls.

While you can use a daily time frame chart for the same purpose, you should use the weekly time frame in Forex trading for this because it is easier to judge the very long-term price action at a glance there. It is also a good idea to drill down and use at least one shorter time frame chart as well, such as the 4 hour or hourly time frames, to fine-tune your trade entries and exits to make them more precise, which also means more profitable.

How to Measure Trend with the Weekly Time Frame

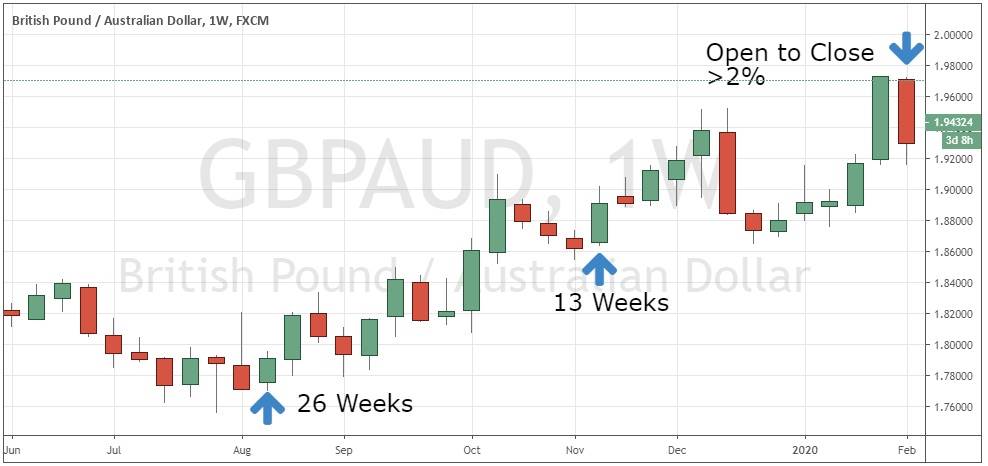

The reason why the weekly time frame is the best time frame for trading Forex is because historical Forex data shows that when the price is higher than it was several months ago, it is more likely to rise than fall, and vice versa when the price is lower than it was several months ago. So, if you pull up a weekly chart, one easy trick you can do to create the best trend indicator, is count back 13 and 26 weeks from the current weekly candlestick. Is the price now higher than it was at those times? If yes, you have a long-term uptrend. If it was lower at both, you have a long-term downtrend. If the results are mixed, you have no trend. Forget all the fancy Forex indicators – this is a method which is both very simple and effective.

For example, the weekly timeframe chart of the EUR/USD currency pair below shows the current weekly candlestick, on the far right, clearly below the opening prices of the candlesticks from 13 and 26 weeks ago. So, there is a clear downtrend, and this week traders can look for short trades in this currency pair.

Weekly Time Frame: Long-term Downtrend

In another example, the weekly timeframe chart of the GBP/USD currency pair below shows the current weekly candlestick, on the far right, closing above the opening price of the candlestick from 13 weeks ago, but also below the opening price of the candlestick from 26 weeks ago. So, there is no long-term trend, and next week traders who want to trade this currency pair should look to trade reversals at support and resistance levels.

Weekly Time Frame: No Long-term Trend

Should You Use Only One Time Frame in Forex Trading?

Although a weekly time frame chart can show you a trading edge, in all except very limited circumstances (explained in more detail below in the “Trading Forex with the Weekly Time Frame Only” section), it is not smart to trade using the weekly time frame alone. In fact, using just a single time frame to trade Forex is usually a bad idea, whatever time frame you might pick. However, using higher time frames such as the weekly price chart, can at least tell you whether there is a long-term trend and if so, in what direction.

There are several reasons why trading using the weekly time frame alone is usually a bad idea:

It is just too long-term and slow to use on its own. While you might easily hold a good trade open on a short time frame such as 5 minutes for fifty candles, if you try holding a trade open for 50 weeks, you will encounter many problems.

Some Forex brokers impose a time limit on the duration of trades, forcing you to close an open trade after it has been open for typically a few weeks or months. Few brokers advertise this fact- you have to check the small print or ask the broker directly to find out..

All Forex brokers, unless you have an Islamic Forex broker account, will either charge or pay you a small amount based on the size of your trade and the interbank interest (“tom/next”) rates of the respective currencies in the pair. Usually, it is a charge and not a credit – the system is biased against the trader and is a way Forex brokers can make money quietly from long-term traders. Even if the fee is typically small, such as a quarter of a pip per day, if you hold a trade open for a long time these overnight swap fees add up and can really eat away at your profit.

Professional traders always use a combination of long-term and short-term time frames. Typically, professional traders will have three timeframe screens open for whatever they are trading showing the daily, hourly, and 5-minute time frame charts.

Multi Time Frame Trading with the Weekly Time Frame

Multiple time frame analysis is simply looking at two or more price charts for the same Forex currency pair or cross or other instrument, at the same time. You make a multiple time frame analysis by looking first at a higher time frame and using that chart to determine whether the price is trending (and if so, in what direction) or ranging, and also maybe to identify clear support and resistance levels. It is a top-down analysis, because once you have that information from the higher time frame, you then use a lower time frame to trade from that analysis, which will usually get you more precise trade entries and exits which should maximize your reward to risk ratio.

There are a few good Forex trading strategies which have historically been profitable on the weekly time frame, outlined below. You can use a shorter time frame as a tool to trade these strategies more effectively.

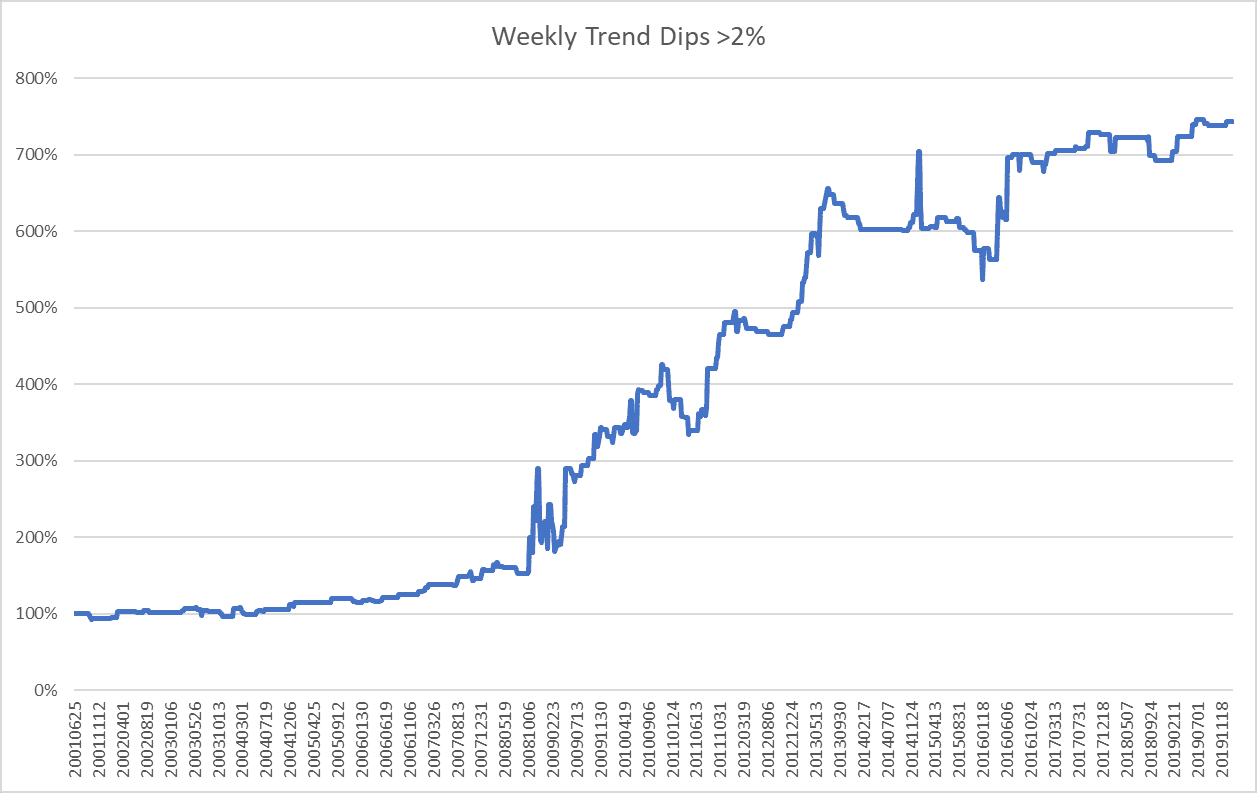

The results detailed below are from back tests conducted on sixteen major and minor Forex currency pairs over a very long period of almost 20 years, from 2001 to 2020. Thousands of samples were taken, increasing the statistical validity of the back test.

Weekly Multi Time Frame Breakout Trend Strategy

When a Forex currency pair or cross ended a week at its highest or lowest weekly close for 26 weeks (equal to 6 months), in 51.10% of cases the next week closed further in the direction of that breakout. However, on average the next week closed against the trend by 0.04%.

If we take only the USD currency pairs from the above example, in 53.94% of cases the next week closed further in the direction of the trend. On average, the next week closed further in the direction of the trend by 0.02%. Although this second statistic is not encouraging, by use of a relatively tight hard stop loss, trading long-term breakouts in USD currency pairs could be made into a profitable trading strategy, but you should use a shorter time frame to make your trade entries and exits more profitable.

Example trade: reusing an earlier image, we see the EUR/USD currency pair with a weekly candlestick making the lowest weekly close in 26 weeks – you can see there is not a single previous candlestick in the price chart with a lower close. Next week, look for short trades on a shorter time frame such as the hourly or 4-hour time frame.

Weekly Breakout Trend Strategy: Short Trade Entry

Weekly Multi Time Frame “Buy the Dips” Trend Strategy

This strategy and all the following strategies rely upon mean reversion. “Mean reversion” means that the price will likely revert back to its average after a sustained directional movement away from the average. You trade mean reversion just by waiting for a turn of direction back towards the average and opening a position targeting the average.

When a Forex currency pair or cross ended a week either above both its prices from 13 and 26 weeks ago, or below both, but the week’s price movement from open to close was against that trend, in 51.71% of cases the next week reversed and went on to close further in the direction of that trend. On average the next week closed with the trend by a further 0.09%, so “buy the dips” seems broadly to work better in Forex than trading breakouts.

If we take only the USD currency pairs from the above example, the results do not improve. This means that the data shows that for USD currency pairs, the win rate has been better trading breakouts, but the overall trade expectancy for the next week was better when “buying the dips”.

Example trade: we see the EUR/USD currency pair with a weekly candlestick closing up from its open – the green candlestick on the far right of the chart. However, this close is below the opening prices of the weekly candlesticks of both 13 and 26 weeks ago, so there is an opportunity here to “sell the rally” (the same as “buy the dip”). Next week, look for short trades on a shorter time frame such as the hourly or 4-hour time frame.

Weekly “Buy the Dips” Trend Strategy: Short Trade Entry

There are also two weekly trading strategies with good track records which can more safely be used with only the weekly time frame.

Trading with the Weekly Time Frame Only

These strategies produce trades which are meant to be entered just as a week ends, and held until the same time next week, without a stop loss. This can of course be traded more precisely by using a shorter time frame as well.

Weekly Time Frame “Buy the Strong Dips” Trend Strategy

When a Forex currency pair or cross ended a week either above both its prices from 13 and 26 weeks ago, or below both, but the week’s price movement from open to close was against the trend by at least 2%, in 55.54% of cases the next week reversed and went on to close further in the direction of that trend. On average the next week closed with the trend by a further 0.41%, so this is historically the best-performing trading strategy outlined within this article.

This strategy does not produce trades very often, as a directional movement in Forex of more than 2% from a weekly open to a weekly close is relatively rare and has tended to happen in only approximately 3% of samples.

This strategy is powerful, because it is based not only upon the market’s tendency to both trend and revert to its mean, but also upon volatility clustering.

Example trade: we see the GBP/AUD currency cross with a weekly candlestick closing down from its open – the red candlestick on the far right of the price chart below. By dividing its closing price by its opening price, we see the result is more than 1.02, meaning we have a strong enough move to generate an entry signal. Also, this close is above the opening prices of the weekly candlesticks of both 13 and 26 weeks ago, so there is an opportunity here to “buy the dip”. You could either just enter long here just before the week closes, or next week, look for long trades on a shorter time frame such as the hourly or 4-hour time frame.

Weekly “Buy the Strong Dips” Trend Strategy: Long Trade Entry

A back-test equity curve of this strategy using weekly moves from open to close greater than 2% in value trading 16 Forex currency pairs and crosses from 2001 to 2020 is shown below. Trades were hypothetically entered at the end of a qualifying week and held until the next week’s close. Spreads and overnight financing payments/charges were not included.

Weekly “Buy the Strong Dips” Trend Strategy: Equity Curve

Weekly Time Frame “High Volatility Mean Reversion” Strategy

This strategy is exactly the same as the previous strategy, just without the trend element.

All you are looking for is for a weekly candlestick to close with a price movement from its open to close of at least 2%. Then you enter a trade in the opposite direction and sell at the end of the next week, regardless of the trend. In 50.73% of cases the next week reversed direction and closed up. On average the next week was a winner by 0.20%.

Example trade: the example above can be used as illustration; you just don’t need to check whether the price is above or below any previous candlesticks: a move from open to close greater than 2% is enough to trigger a trade entry signal.

Final Thoughts

Forex traders will find they can trade much more profitably by using the weekly time frame to find trending or ranging conditions, and then trading in line with those conditions by drilling down to a shorter time frame to execute precise entries and exits. The 4-Hour or 1-Hour time frames are ideal.

In Forex, trends tend to be most accurately identifiable over 3 months and 6 months.

Traders wanting to trade a strategy using only the weekly time frame are well advised to trade without leverage, and also to consider using a consistent hard stop loss, as the maximum drawdown of this strategy on 16 Forex currency pairs and crosses observed over the past 20 years was approximately 38%.

How to use the weekly time frame in Forex trading?

- Identify whether there is a long-term trend or range in a currency pair or cross by checking price moves over last 3 and 6 months

- Identify the direction of the long-term trend if there is one and trade it

- Drill down to lower time frames to fine-tune your trade entries

- Trade reversals from support and resistance when there is no trend and the price is ranging

- Buying dips in trends is usually more profitable than trading breakouts in Forex